We Shouldn’t Defend the JCPOA at the Expense of the Iran Deal

◢ The JCPOA has now persisted for two years, and Iran is beginning to see post-sanctions benefits. But American support for the deal is wavering, and deal supporters in Washington have upped their advocacy.

◢ But deal supporters often describe the JCPOA as an unusual concession from an otherwise threatening Iran, a characterization that undermines much of what the Iran Deal has achieved so far.

This article was originally published in LobeLog.

On the two-year anniversary of the agreement, U.S. supporters of the Joint Comprehensive Plan of Action, including many former Obama administration officials, are admirably working to defend the deal through media appearances and coordinated statements. Their message that “diplomacy works” is an important one at a time when America’s global leadership seems in doubt.

However, the rhetoric in Washington defending the JPCOA remains problematic, because it pursues the preservation of the deal in a way that undermines the unfolding detente between Iran and the international community.

On Morning Joe, former Secretary of Energy Ernest Moniz, noted that the Iran deal has eliminated the “existential threat” posed by a nuclear Iran, echoing similar language used by Secretary Kerry and other members of the Obama administration to support the deal since 2015. Similarly, Colin Kahl, another former Obama administration official, has argued in a piece in the New Republic that “If Trump exits the agreement, the prospects of a nuclear-armed Iran—or a major war to head off that outcome—would increase.” Moreover, these risks of escalation are amplified when deal supporters argue that Trump is already in breach of the Iran deal, and that these breaches are part of a concerted effort by hawks to bait Iran into conflict.

Although they seek to demonstrate the efficacy of the JCPOA, these arguments also work to confirm the demonization of Iran peddled by those opposed to the deal. The diplomatic triumph of the JCPOA is cast as directly proportional to an Iranian threat described in nearly essentialist terms. For example, the argument that the collapse of JCPOA would immediately prompt Iran to pursue a nuclear weapon suggests that it’s impossible for Iran’s leadership to choose any other strategy in response to a US withdrawal from the agreement. The argument gives the US full agency to tear up the deal but denies Iran any agency to choose not to proliferate. It also ignores the importance of the other parties to the JCPOA.

Relying on the received wisdom of Iran’s perennial threat to underscore the importance of the JCPOA is perhaps the most politically palatable way to defend the deal in Washington. But it also demonstrates that the talking points around the JCPOA have not significantly advanced in two years. The stagnant rhetoric also reflects a fundamental misunderstanding of how the other members of the P5+1 see the JCPOA.

What American deal supporters and opponents alike fail to recognize is that the JCPOA and the Iran deal are not the same thing. The difference is best described through the lens of basic game theory. Whereas the JCPOA was just one “round,” the Iran deal describes an ongoing “game.”

The Prisoner’s Dilemma

When focusing on the JCPOA alone, American deal supporters find themselves essentially defending the agreement as the unlikely outcome of a situation akin to the traditional prisoner’s dilemma. They suggest that although both the US and Iran had reasons to defect in the “game” of the negotiations to win the upper hand, the two sides decided instead to choose mutually beneficial cooperation—what the Iranian’s called aptly the “win-win” solution.

But this conception of the JCPOA completely misses the full scope of the game that Iran, Europe, Russia, and China are currently playing. The JCPOA is not the final payout of a prisoner’s dilemma-type game. It is rather just one round, which marks the beginning of a long chain of iterated negotiations that can be collectively called the “Iran deal.” As we have seen since July 14, 2015, Iran has been engaged in a multiplicity of new negotiations in both political and commercial spheres. That Iran is successfully engaging in an integrated game with numerous actors also shows that Iran deal supporters in Washington are misconstruing the agency of Iran as a rational player in the game.

When actors enter into an iterated game, the incentives around defection or cooperation change completely. If one side knows that defecting in one round of a game is likely to lead to punishment in the next round, the cost of defection goes up. Rational actors are expected to cooperate more often in games with a large number of iterated interactions. For Iran, reciprocating any American escalation would mean defecting from the constructive path it has taken with other players in the international community. On this basis, not only is the argument that Iran will necessarily reciprocate American escalation dubious, but it also ignores the fact that the costs of escalation for Iran are much higher now, particularly because Iran is cooperating fruitfully with so many other actors in the international system.

A tendency towards cooperation is evident in the quick warming of ties between Iran and other global powers over the last two years. The JCPOA launched a new “game” in which an expanding pool of players could adopt strategies of mutual cooperation, leading to positive outcomes. This includes everything from relaxed visa requirements and educational exchanges to the much-heralded commercial contracts from the likes of Boeing, Airbus, and Total. As the wider Iran Deal continues to fulfill its promise in each successive round, trust builds and the optimal strategy of mutual cooperation is reinforced.

The risks of defending the payout of the round while harming the overall game are clear. By using the risk of escalation, proliferation, and conflict to justify adherence to the JCPOA, its supporters in the United States are undermining both the logical and empirical basis for a more cooperative political strategy from Iran. The “deal-or-war” narrative makes it harder for Americans to see the JCPOA as anything more than an exceptional political concession from Iran rather than an instance of an increasingly clear pattern of rational and constructive behavior. In this sense, JCPOA supporters are deploying arguments that could even give further credence to the popular American conception of Iran as a country that can only act as a rogue state, regardless of the particular government in power or the tenor and type of policies that the government consistently adopts in consideration of myriad internal and external incentives.

Remember Europe

Finally, American supporters of the JCPOA need to be careful not to undermine European advocacy around the wider Iran deal. The approach taken by JCPOA supporters in Washington overstates the centrality of the United States to the success of the Iran deal at large. As Federica Mogherini reminded her American counterparts in comments this week, “The nuclear deal doesn’t belong to one country, it belongs to the international community.”

No doubt, if the U.S. pulls out of the agreement, domestic political forces in Iran could interfere with President Hassan Rouhani’s agenda for international engagement. But the multiplicity of actors involved in subsequent rounds of the Iran deal mean that Iran will retain strong incentives for cooperation with these other players even in the face of US escalation. This is why the Europeans have chosen to advocate for the Iran deal in Washington on the basis of the moderating impact of political and commercial engagement.

American deal supporters need to make sure their advocacy remains consistent with this message, which ultimately reflects the more salient explanation for the continuing success of the JCPOA. Harping on fears of a regional conflagration further conditions American politicians to think Iran cannot see the horrendous costs, now rising, of such a political failure, and this conditioning could thereby undermine receptiveness to the empirical evidence of moderation offered by the recent European experience with Iran.

Ultimately, game theory teaches us the importance of trust. Those who supported the JCPOA as it was being negotiated clearly trusted their Iranian counterparts to stick to their word. The defense of the deal should better reflect this spirit.

Photo Credit: Wikicommons

Country Managers Are Making Post-Sanctions Iran Work

◢ Behind every successful multinational deal in Iran is a country manager. These executives seek to balance the commercial goals of their companies with the needs of Iran's post-sanctions economy.

◢ Country managers are a critical link in what is essentially a bureaucratic system. Policymakers need to help make this bureaucracy work better with better rules and systems so that country managers can succeed.

This article was originally published in LobeLog.

On July 3, Patrick Pouyanné, the imposing, former rugby-playing CEO of Total, arrived in Tehran to sign a landmark $5 billion contract to develop Phase 11 of Iran’s South Pars gas field in cooperation with the China National Petroleum Corporation and Petropars, an Iranian firm. The deal was a sign of Pouyanné’s ambition and resolve in the face of the Trump administration’s rhetoric towards Iran.

But the credit for the deal should not go to Pouyanné. Behind every CEO who travels to Iran to sign a deal, there is a “country manager” who paved the way. In the case of Total, it is Eric Festa, whose formal title is managing director for Iran. Erik is one of a small but growing brigade of country managers who are on the front lines of Iran’s post-sanctions economy.

These country managers are tasked to conduct business in a market, which multinationals euphemistically classify as a “growth market” or “development market.” The country managers typically assigned to Iran have experience operating within other similarly complex markets. Most country managers do not have Persian language skills, though some companies have assigned diaspora Iranians to the role. Country managers are chosen for their understanding of the need to balance relationship-based business with strict attention to issues of risk management and compliance. They also tend to have something of a taste for adventure and a willingness to adapt to a new business culture. Some have relocated to Tehran, but most travel in and out of the country every few weeks.

“Country manager” is a grab-bag term. As a rule of thumb, the formal job title of the country manager reflects the stage of the multinational corporation’s investment in Iran. At the earliest exploratory stage, the individual could merely be a head of a project office. As the commitment to the market grows, the job gains more authority, and “country manager” becomes the more common title. As the business moves to a rollout phase, the title is commonly elevated to a corporate vice president role where the individual is also the director of the Iran business unit. For the multinationals with the most advanced investments, such as a dedicated subsidiary or joint venture, a CEO or managing director with significant autonomy and authority often leads the Iran business, overseeing a staff in the hundreds.

The Western policy community has devoted significant time and resources seeking to locate influence within Iran’s political structure, often using its byzantine nature as an excuse to declare, for reasons of expediency rather than clear evidence, that a certain individual or office is the most powerful. Yet, far less attention has been given to the organizational structures that govern the flow and operation of post-sanctions international capital into Iran.

A Useful Bureaucracy

Country managers are the critical actors behind post-sanctions investment in Iran, but they remain essentially invisible in the structure and organization of that trade. It is telling that there exist more flowcharts explaining political decision-making in Iran than commercial decision-making.

The consequence of this blind spot is an inherent distortion in the way power and influence in Iran are understood. This distortion is particularly acute given the status of economic development as the fundamental political priority across Iran’s political spectrum. This economic development hinges on the success of country managers in balancing the commercial directives of their companies with the political and practical needs of Iran’s industries. At the moment, most analyses of Iran’s post-sanctions political economy presuppose that Iranian power brokers such as members of the Revolutionary Guard are unilaterally setting the terms for commercial activity. But in reality, the process of post-sanctions trade and investment is an ongoing negotiation in which country managers have meaningful leverage: the ability to withhold much-needed foreign investment.

On this basis, a full assessment of power and influence in Iran today must account for the role of the country manager. Max Weber, when he long ago posited the concept of the bureaucracy, dispelled the idea that state administration and industrial administration were distinct. Not only are the administrative methods of the state and industry effectively the same—reflected both in the technocratic tendencies of Iran’s political class and in the emergence of multinational corporations as so-called “private empires”—but the execution of large-scale trade and investment also requires the functioning of a single overarching bureaucracy involving governmental and corporate actors from both the domestic and foreign spheres. Country managers, who serve as the administrative link between these two spheres, are the central bureaucrats of post-sanctions trade and investment in Iran.

The bureaucratic nature of trade and investment, which favors rational, technical, governable, and stable decision-making, also makes the attendant processes inherently vulnerable. Although country managers may be quite influential in Iran, none would ever boast about their power or influence. Like most bureaucrats, they feel beholden to systems much greater than themselves. Iran ranks low in ease-of-doing-business, and by no means are its domestic state or industrial bureaucracies efficient. Iran’s post-sanctions reintegration with international systems for enterprise and finance has proven difficult, and country managers experience these myriad challenges firsthand.

Strengthening the Bureaucracy

To improve the expected outcomes associated with the new influx of trade and investment in Iran, the policy community that supports constructive engagement must do more to empower country managers by addressing vulnerabilities in the bureaucratic structure in which they operate. Interventions are needed on a few fronts.

Continuing to borrow from Weber, a bureaucracy depends greatly on its legitimacy. Country managers struggle to position themselves as effective negotiators because they have a difficult time signaling that their leverage within the given commercial negotiations matters. This leverage centers on the notion that country managers can withhold the investment of their multinational companies if terms are not attractive. However, so long as a narrative persists that other political forces may prevent that investment anyway, the country manager has little to no leverage. It is not the case, as some suggest, that political uncertainty is making Iranians desperate to strike deals. Iranians see little reason to engage in reforms and offer more favorable terms when the payoff is not certain. This fact explains why European governments have devoted so much effort to tightening the coordination between government and commercial actors in regards to Iran. The creation of a credible political commitment has been fundamental to the strengthening of the negotiating power of the country managers. Importantly, in this regard, European ambassadors serve as a kind of political partner to the country managers in Iran.

However, the effort to legitimize trade and investment in Iran has its limitations. The permissibility of trade and investment in Iran is no longer primarily a question of legitimacy. Although the legal basis for post-sanctions trade provides a rational, legal authority for those who wish to pursue that business, there remains a “fear factor” associated with Iran that is sometimes inherently irrational. Policymakers have been hesitant to engage concerns around the perceived moral dubiousness or danger of engaging commercially with Iran, perhaps because they see these matters as reflective of a fraught emotional politics. But there needs to be a greater understanding that these emotional issues have a direct bearing on the ability of Iran trade and investment to become more fully bureaucratic, and thereby more fully constructive. Unless steps are taken to provide assurances on the permissibility of trade and investment beyond the basic question of legality, the fuller picture of legitimacy will never be addressed, and therefore bureaucratic actors such as country managers will always remain hamstrung, unable to fully articulate the legitimacy of a proposed engagement to key stakeholders. They will constantly struggle to relay their on-the-ground knowledge of Iran to decision-makers whose impressions are shaped by threatening headlines.

The country manager must also be empowered with a rational commercial framework in which to operate. The rules that govern trade and investment in Iran remain relatively disorganized. Lingering issues around international sanctions and Iranian regulatory frameworks alike mean that companies need to continually evaluate the rules of engagement. As such, country managers who play roughly the same role within the companies across national affiliations and across industrial sectors find themselves spending inordinate amounts of time simply clarifying the rules for their own specific commercial activities.

The most significant example can be seen when multinational corporations seek a specific license for their Iran business activities, principally from the U.S. Office of Foreign Assets Control. With this licensing policy, the U.S. political establishment is using its tools of administration to exercise jurisdiction over the bureaucratic function of European trade and investment. One bureaucracy is undermining another for the ostensible purpose of protecting security interests. But in forcing Iran trade to be less bureaucratic, less regular, and less basically normal, the policy is counterproductive.

Although general licenses are meant to set non-specific, system-wide rules about the administration and operation of business in Iran, persistent ambiguities prevent the creation of a standard practice that establishes such rules. Add to this the reputational issues around engaging with Iran and the rationale for business in Iran remains a very personal decision, dependent on the resolve and risk appetite of the country managers and their superiors. On the Iranian side, a similar personal dynamic exists. The acceptability of a commercial arrangement is based to a large extent on the strictness with which key stakeholders, such as Iranian ministers or commercial partners, apply formal regulations (such as protectionist laws) and uncodified expectations (such as political resistance).

Defining Best Practices

To address both jurisdictional interference and the personal contingency of trade and investment, European governments and industrial companies must develop a more rigorous set of standard practices that establish the rational rules for engaging with Iran. To do so, far greater effort must be spent on policy research to devise and implement best practices for Iran. Just as few studies have been made to locate domestic and foreign commercial actors within Iranian power structures, little research is being conducted to examine issues of industrial policy, economic planning, and management practices within the Iranian context. Relatively few events and forums bring country managers into dialogue with experts who can help define best practices.

The existence of best-practice rules and guidelines will also improve the bureaucratic operation of trade and investment in Iran by making individual country managers more dispensable. At the moment, the entrepreneurial nature of the role means that when country managers leave their post, the learning curve for their successor is especially steep. This “key person risk” prevents the smooth functioning of trade and investment. Iran will struggle to see adequate trade and investment if deals rely too much on the quality of the individual country manager or the administrative wherewithal of the particular company. Although Total may have been the first international oil company to sign a post-sanctions contract precisely because of the company’s unique strengths, the success of post-sanctions investment depends on the emergence of durable, sector-wide competencies.

Over all, the ability for country managers to facilitate economic development in Iran that is both great in magnitude and constructive in impact will depend on the ability for trade and investment in Iran to operate along more regularized and bureaucratic lines. To do so, policymakers must recognize the central role played by country managers in the legitimization and rationalization of commercial engagements with Iran. It is easy to take bureaucracy for granted. But in the delicate effort to improve the political and economic administration of Iran’s post-sanctions trade and investment, success must be systemic.

Photo Credit: Total

Telepizza's Arrival in Iran Shows Supersized Ambition

◢ The arrival of Telepizza, a global fast-food brand, is a significant development for Iran's food service sector.

◢ The terms of the master franchise keep economic dividends in Iranian hands, and the new entrant will likely spur new investment and improvements in offerings across the sector.

In 1990, during the final year of the Soviet Union, McDonald's opened its first branch in the country, choosing a landmark location in Pushkin Square in Moscow. On the first day, nearly 30,000 customers passed through the doors.

Telepizza, an international fast-food pizza chain, opened its first Tehran location last week. While the opening did not see quite the same fanfare as arrival of McDonald’s in the USSR, the launch is nonetheless significant.

As many articles have emphasized, Telepizza is the largest non-American pizza brand in the world by number of stores (about 1,500). But the Spanish company, which is targeting Iran as part of an ambitious global rollout plan, is one of the first globally-recognized restaurant brand to enter Iran, which has until recently had to make do with cheap imitations such as “Pizza Hat” and “Mash Donalds.”

The arrival of Telepizza follows the awarding of a master franchise agreement to Momenin Investment Group, a little known firm registered in the UK but with Iranian ownership. MIG has committed to spending EUR 100 million over 10 years in an Iran market rollout. The size of the investment makes it clear that Telepizza and MIG are aiming to dominate the market.

The fast-food sector in Iran is among the most attractive for investors, who see a large middle class with growing spending power. Today, Iranians spend about USD 7 billion annually in restaurants, of which about one-third is spent on fast-food. This expenditure is likely to double in the next decade.

To meet demand, there are about 20,000 fast-food outlets in the country, but scale has remained elusive for any single brand. The largest fast-food operators in Iran, including brands such as Haida and Boof, operate around 50 locations each. In many respects, the fractured food service sector reflects similar dynamics in the food retail sector.

It can be tempting to see the absence of major fast-food brands in Iran as a mark of Iran’s resistance to neoliberalism and the attendant exploitation. The prospect of Iranians spending their hard-earned Rials on foreign pizza is seen by many as anathema to the promise of an independent, self-sufficient Iran.

But Iranians, like most people around the world, want to enjoy the occasional pizza. They naturally deserve the best pizza at the best price. The simple fact that no Iranian fast food chain has gone on to dominate the world, suggests that there are improvements to be made in the domestic offering.

Encouragingly, the Telepizza deal keeps Iranians in charge of their own fast-food future. Whereas the McDonald’s in Pushkin Square was company-owned (the “Golden Arches” made its first franchise agreement in Russia in 2015), Iran’s Telepizza locations will all be owned and operated by MIG. This means that the Telepizza deal is consistent with the longstanding pattern of cooperation between Iranian and multinational enterprises.

Across sectors, Iranian companies have typically sought foreign assistance in technology and operations to enable more successful domestic production. Examples include IKCO’s manufacturing of French cars, Sahar Dairy’s manufacturing of Danone Products, and NIOC’s production of oil with Shell’s technology and expertise.

A similar dynamic underpins the Telepizza deal. Domestic fast-food operators in Iran have struggled to ensure efficient supply chains, intuitive inventory and sales technologies, robust brand protection, and winning management practices. This has made scale all but impossible to achieve.

These areas are precisely where a franchisor like Telepizza can offer support. Telepizza offers MIG access to unique intellectual property in the form of the food menu and branding and marketing collateral, as well as providing assistance in creation of a supply chain, training for management and staff, and implementation of key technologies for ordering, sales, and delivery. They also bring the experience of successful rollouts in other complex markets.

If Telepizza and MIG can adapt the global formula for success to the Iranian market, the food sector at large will be jolted by the new and highly-competitive entrant. This should see other fast-food chains in Iran driven to improve their product, and it will also encourage further foreign and domestic investment in the sector. Outcomes include consolidation among existing players and a diversification of the market offering for consumers.

Moreover, consolidation in the fast-food sector around a few key brands will also mean consolidation of buying-power for the food products that go into each pizza, hamburger, or burrito. Today, McDonald’s in Russia purchases most of its supplies from domestic producers. The fast-food chain’s growth was a major contributor to consolidation and expansion in Russia’s agricultural sector. A similar outcome could be expected in Iran, where large-scale farms remain rare, leading to inefficiencies across the value chain.

While the prospect of increased competition and purchasing power leading to better market offerings is consistent with the neoliberal doctrine, it is important to note that both ownership and labor will likely remain in Iranian hands. Under a master franchise agreement, the franchisor (Telepizza) would typically be entitled a recurring franchise fee and a percentage of profits, but MIG is the owner of the Iranian company and the principal beneficiary of profits. It is MIG's entrepreneurial skills that will be tested as the brand seeks to expand.

Additionally, and perhaps most importantly, expansion in the fast-food sector is a job creator precisely where Iran needs it most. Such stores typically hire younger employees who are attracted to the flexible, shift-based work schedule. Lack of significant growth among domestic players means that possible job creation has gone unrealized.

For young Iranians seeking their first jobs, or trying to make some additional income while pursuing their studies, the type of work on offer at a fast-food restaurant could prove ideal. After all, many of the world’s greatest entrepreneurs got their start delivering pizzas.

Telepizza's supersized ambition in the Iranian market might only be matched by the ambition of these yet-unheralded pizza delivery men and women, waiting for their chance.

Photo Credit: Telepizza

Long-Awaited Total Deal Signals Rising Investor Confidence in Iran

◢ On Monday, Total will sign a long-awaited USD 5 billion deal to develop Iran's South Pars gas field, becoming the first international oil company to commit to a post-sanctions investment.

◢ The Total deal indicates rising confidence that political and banking challenges can be addressed, and the contract signing will likely buoy investor confidence across sectors.

On Monday, Total will sign a long-awaited contract to develop Iran’s South Pars gas field in cooperation with China National Petroleum Company and Iranian firm Petropars. Total has been involved in developing the South Pars project since 1997 when it was the first international oil company to be awarded a contract following the Islamic Revolution. The landmark deal, which sees Total committed to a 20 year development roadmap, is valued nearly USD 5 billion. Total's share is 50.1%.

The announcement of the contract signing ceremony follows eight months of deliberations since the heads of terms was signed in November 2016. In the intervening period, Total has had to navigate a changing political environment, stubborn banking challenges, and wavering investor confidence. The move to conclude the contract signals positive developments in each of these three areas.

Total CEO Patrick Pouyanné, who has shown some bravado by speaking publicly about this deal as it progressed, had stated in February that progressing to a contract was contingent on the U.S. continuing its implementation of secondary sanctions relief as part of the Joint Comprehensive Plan of Action (JCPOA). With the increasingly hostile rhetoric of the Trump administration, continued sanctions relief had remained in doubt. But the administration has since confirmed Iran's compliance with the JCPOA and issued the relevant sanctions relief waivers in mid-May. Just a few days later, Iranian president Hassan Rouhani won a landslide reelection, solidifying his mandate to pursue international engagement and investment.

Total will also feel secure in the fact that European government leaders have been very vocal in their support for Iran and the nuclear deal. Federica Mogherini, Theresa May, Angela Merkel, and a host of European ambassadors have strongly advocated that the US stay the course with the nuclear deal both at the White House and on Capitol Hill. Looking together at these factors, Total must feel confident that the political environment remains conducive to the company's long-term investment in Iran.

At a more practical level, Pouyanné had acknowledged in April that Iran’s as-of-yet unsolved banking challenges were an impediment Total’s investment. The hesitance of international banks to provide financing or facilitate the recurring transactions necessary for day-to-day business in the country required Total to make a special effort to find its own solution. Pouyanné disclosed that Total was testing a new banking mechanism to get money in and out of Iran in a compliant way. This likely means that a medium-sized bank, probably French, has carved out a channel for Total to transfer funds to Iran without involving U.S. persons or U.S. dollars, thereby avoiding a so-called “U.S. nexus.”

While major European banks remain hesitant to do this kind of creative banking for Iran transactions, boards of directors are showing an increasing willingness to make exceptions on behalf of their largest clients and at the behest of national governments. Total's move suggests that the banking channel they created works, and this fact may help other large firms in their negotiations to receive banking facilities for Iran business.

Finally, Total’s contract signing will no-doubt boost confidence across sectors among both international and domestic investors. While Boeing and Airbus have notably concluded major contracts prior to the Total deal, the agreements for the sale of aircraft represent large-scale trade. The Total deal, which involves direct ownership and operation of physical, immovable assets in Iran, is true foreign direct investment with all of the attendant risk. That Total is proceeding is even more impressive considering the company will not start seeing revenues until 2021, when it has committed to bringing the first new gas to Iran's large domestic market.

Additionally, proceeding to a full contract reflects that Total was satisfied with the terms of Iran's new standard oil and gas contract, known as the IPC contract. While Total’s clear desire to be the first-mover in Iran’s energy sector has meant that they have been somewhat more willing to overlook the known deficiencies in the IPC model, fear of missing out may see peer companies like Shell, Eni, and OMV decide to press forward with their own investment plans within the existing IPC framework.

For Iran, the true value of the Total deal lies outside the oil and gas sector, which only accounts for about one-fifth of the country's economy. Rather, it is the investor confidence furnished by the Total deal, which will spur activity in other areas like infrastructure, transport, pharmaceuticals, and FMCG, that will really move the needle. Investors in these sectors will no-doubt welcome the deal as the sign of a rising tide.

Photo Credit: Wikicommons

To Break With Austerity, Rouhani Must Deliver on Sovereign Debt Sale

◢ To win foreign investment, Iran's needs to boost development expenditures. But expansionary fiscal policy will require a new source of revenue, as oil sales remain stagnant and tax rises remain politically risky.

◢ A sovereign debt sale, long discussed by Iranian officials, is the fundamental way Iran can find the revenues to self-fund growth. The Rouhani administration must focus on making its bond offering a reality.

One of the remarkable, and yet little discussed, aspects of the Iranian election is that Hassan Rouhani triumphed despite being an austerity candidate. His first term was notable for its frugal budgets and commitment to both slash government handouts and reduce expenditures in an effort to tackle inflation. On one hand, the focus on a more disciplined fiscal and monetary policy meant that Rouhani could point to a successful reduction of inflation from over 40% to around 10% while on the campaign trail. On the other hand, job creation has been stagnant and the average Iranian has seen little improvement in their economic well-being.

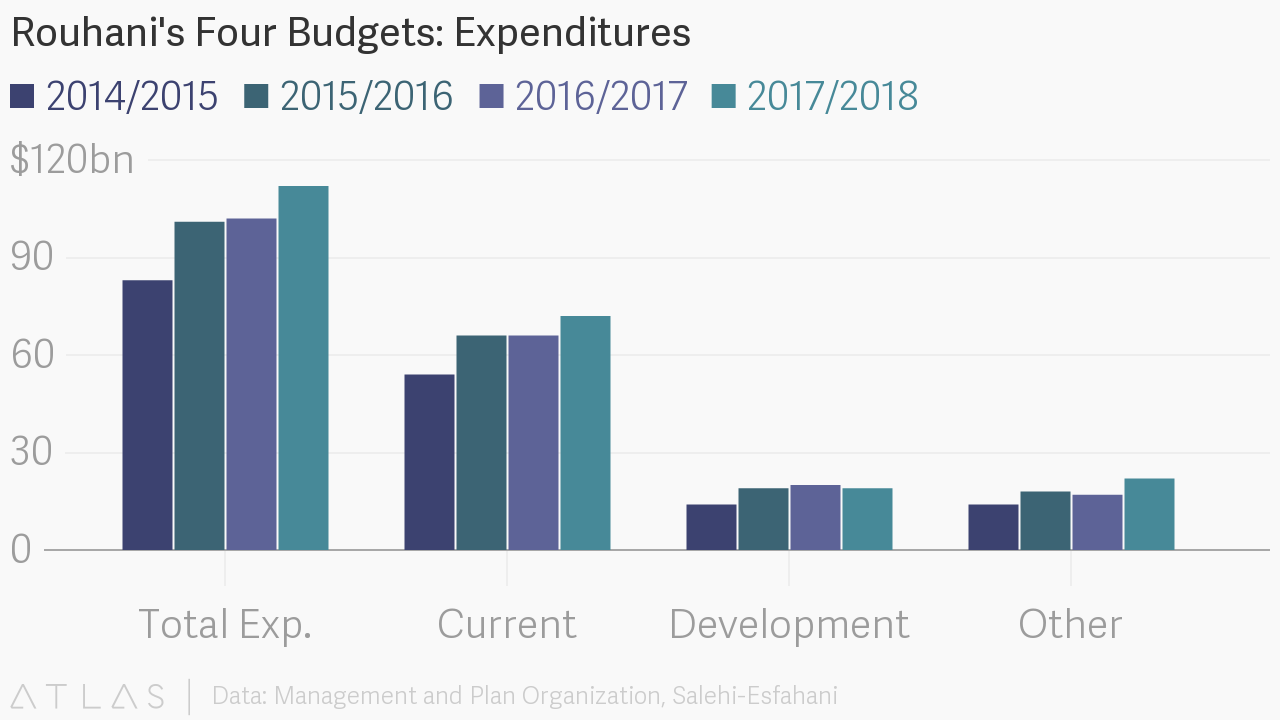

Some economists, including Djavad Salehi-Esfahani, have argued that Rouhani’s austerity economics are misguided, depriving the economy of vital liquidity that could help jumpstart investment and job creation. For example, Iran’s 2017/2018 budget sees tax revenues stay constant at an equivalent of USD 34 billion despite the fact that economic growth is expected to top 6%. Salehi-Esfahani believes that these figures reflect the Rouhani administration's belief “that letting the private sector off easy would encourage it to invest.” The government, meanwhile, will not contribute much more in investment. Development spending is set to decrease from USD 20 billion to USD 19 billion.

Surely, the Rouhani administration’s pursuit of a small government that leaves the burden of job creation and economic growth to the private sector is admirable. It represents a significant shift in the mentality that has characterized the economic policy of the Islamic Republic, which has long relied on state-owned enterprise and state-backed financing, supported by oil revenues, to drive economic growth.

But the volume of investment needed to revitalize economic sectors and create substantial job opportunity has not yet materialized. This is an undeniable fact, which Rouhani has attributed to failures on the part of Western powers to adequately implement sanctions relief, leaving international banks unable to work with Iran. Rouhani’s opponents meanwhile, attributed low volume of foreign direct investment to his administration's mismanagement. There is truth to both accounts.

In many ways, Rouhani’s lean towards austerity was a response to the spendthrift policies of his predecessor, Mahmoud Ahmadinejad. The Ahmadinejad administration responded to faltering economic growth during a period of historic oil revenues by ploughing oil rents into the banking system and compelling banks to issue loans. These loans were often provided without the adequate due diligence and were used not to finance growth, but increasingly to fuel speculation, or more forgivably, to address cash flow difficulties faced by companies as a result of international sanctions.

As a result, Iran’s banking sector is now weighed down with a high proportion of non-performing loans, accounting for around 11% of total bank debt. When bank balance sheets grew increasingly precarious as non-payment of loans mounted in the sanctions period, competition for deposits grew. Exacerbating this competition, banks needed to provide higher deposits rates in order to stay ahead of inflation. The combination of forces pushed interest rates up to all-time highs.

The debt market in Iran is now broken. The IMF has urged urgent action to “restructure and recapitalize banks.” In the meantime, banks remain disinclined to lend and in the instances where healthier banks are able to provide loans, borrowers must contend with the high cost of debt.

This may help explain why the Rouhani administration so aggressively sought to address inflation—it was a necessary step to reduce the benchmark interest rate, which has so far been reduced from a high of 22% in 2014 to the current rate of 18%.

But even at such time that interest rates normalize, barriers will remain to the use of debt markets. At a structural level, Iranian companies, particularly in the private sector, rely on equity financing rather than debt financing in order to fund growth. This reflects a “bloc” behavior within Iranian enterprise. Partially as a consequence of the continued dominance of family-owned businesses in Iran’s non-state economy, business leaders tend to approach financiers within their own networks or holding groups, and many of Iran’s largest companies and banks anchor conglomerates that grew out of sequential processes of a kind of inward-looking venture capital. There is limited comfort among Iranian business leaders to seek funding from groups outside of these tight networks and by the same token, equity investors hesitate to provide finance projects outside their own networks. This means that the pool of available investor capital is rarely competing across the whole pool of available capital deployments—a significant inefficiency.

Growth-oriented investing itself can be a difficult strategic proposition. Iranian business leaders have understandably prioritized weathering periods of uncertainty over the execution of long-term plans. The challenge of dealing with short-term volatility has naturally favored short-term thinking. Major companies are only recently undertaking strategic reviews that might identify needs to invest in capital improvements or new services in order to drive growth in support of long-term goals.

The combination of the bloc effect in equity financing and the broken debt market creates a major brake on economic growth, especially from a supply-side perspective. To restore momentum, a third party is needed to order to reset the incentives and mechanisms around financing in Iran.

From the outset of its tenure, the Rouhani administration has hoped foreign investors would take on this role. An influx of foreign investment would have triggered growth without requiring the Rouhani administration to pursue difficult political gambles, such as expanding government expenditure for growth investments in the same period in which welfare programs are being culled. Moreover, the administration’s budgetary leeway was significantly reduced given the persistently low price of oil, making any such balancing act even more fraught.

Eighteen months after Implementation Day, it is clear that the administration significantly overestimated both the attractiveness of the market and underestimated the hesitation of major banks to resume ties with Iran. Investing in Iran is neither easily justified nor easily executed.

The country lacks two essential qualities that have characterized most emerging and frontier markets in the last decade. First, most emerging economies are not as diversified as Iran’s, and do not have such a large arrange of incumbent players with whom any foreign multinational or investor will need to compete for marketshare. There tend to be more “greenfield” opportunities in which lower capital commitment can generate higher returns. Second, a nearly universal feature among emerging markets is the consistent application of both expansionary monetary and fiscal policy. Such policy makes it possible for each investor dollar to achieve a higher return.

In its commitment to reduce interest rates and return the debt markets to normalcy, the Rouhani administration is pursuing an appropriate monetary policy—eventually lenders will become active again. But what remains perplexing is the insistence on austere government budgets in the face of low commitment from foreign investors.

It is clear that the Rouhani administration cannot easily spend tax and oil revenues on long-term projects. Oil revenues are stagnant and there is limited political will to raise taxes. At current levels of government revenue, the political risks of such expenditure are high; as the presidential election showed, populism remains a potent rallying cry among Iranian voters. But foreign investors can’t be expected to step into the gap. Direct equity investments remain a hard sell when domestic financing, whether in equity or debt form, remains throttled and liquidity challenges abound.

There is however a feasible solution that has seen much discussion, but little action—Iran’s return to international debt markets. A sovereign bond issue would both provide Iran’s government the opportunity to raise expenditures in a way that does not draw from existing sources of state revenue by providing a wide class of investors exposure to Iran’s expected period of economic growth. Such a security, ultimately backed by the country’s oil revenues, would serve to mitigate perceptions of country risk for creditors.

In May of 2016, Iran’s finance minister Ali Tayebnia disclosed that discussions were taking place with Moody’s and Fitch over restoring Iran’s sovereign credit rating. One year later, the debt sale continues to be a point of discussion. Recently, Valliolah Seif, Governor of the Central Bank of Iran, commented that the country will issue debt “when [Iran] becomes certain that there is demand for [its] debt.”

Seif’s comments allude to the essential problem of Iran’s planned debt sale—marketing. In order to get Iranian bonds onto the market in any substantial way, the country would need the support of major international banks to serve as underwriters. But banks remain hesitant due to sanctions and political risks.

Turkey, a country which presents creditors significant political risk without mitigation of oil revenues, was able to raise USD $2 billion in a Eurobond sale in January of this year. The sale was underwritten by Barclays, Citigroup, Goldman Sachs and Qatar National Bank.

Iran, is fundamentally a more attractive investment opportunity than Turkey. But major banks remain hesitant to provide financial services to Iran. The Rouhani administration needs to make the sovereign debt sale a core focus of its dialogue with European and global counterparts, and insist on political and technical support in order to entice 2-3 major banks to come on board. In the same manner that the Joint-Commission oversees implementation of the Iran nuclear deal, a multidisciplinary working group needs to be formed to manage the implementation of the debt sale. With the right stakeholders engaged, one can a combination of early-mover banks from Europe, Russia, and Japan agreeing to underwrite the bond issue.

Encouragingly, the delays may have played to Iran’s favor. Emerging markets are just now beginning to rebound, and investors have driven sovereign debt sales to record highs. The Rouhani administration must seize this opportunity and move beyond the limitations of its present austerity economics.

Photo Credit: Wikicommons

The Stage is Set, But Will Rouhani Deliver in His Next Act?

◢ A resounding election victory has renewed Rouhani's popular mandate, but following President Trump's speech in Riyadh, the prospects for improved US-Iran ties remain remote.

◢ But by taking the high road, Iran can still make progress in its international relations, especially if it aims to forge deeper ties with Europe.

Last Friday, Hassan Rouhani emerged victorious in Iran’s contentious election, winning nearly 60% of the vote in a contest which saw 72% turnout. The clear victory confirms the incumbent’s popular mandate, and reflects the electorate’s belief that he remains the only politician able to lead on Iran’s wide range of economic, political, and social challenges.

Crucially, his chief opponents Ebrahim Raisi and Mohammad Bagher Ghalibaf were unable to present a cohesive alternative to Rouhani’s economic program, relying instead on unrealistic promises to expand welfare handouts to Iran’s lower classes.

The promises of greater handouts had an undeniable appeal, however, as voters aired their frustrations with the lack of improvement in their standard of living during Rouhani’s first term. While growth has rebounded since the lifting of international sanctions, stubborn unemployment and wage stagnation have left the average Iranian patiently waiting for the much touted windfall of the nuclear deal. Nonetheless, Iranian voters understand that international engagement is a precondition of any eventual improvement in their economic fortunes. In a boon to electoral fortunes, Rouhani and his administration were widely and credibly seen as the most effective advocate for Iran’s international relations.

Yet, just two days after Rouhani’s victory, American President Donald Trump issued a scathing address from the specially-convened Riyadh Summit, during his first overseas trip. Trump’s speech, issued in concert with the Saudi leadership, cast Iran as a chronic human rights violator and the leading supporter of international terrorism. He called for the international community to isolate Iran.

The juxtaposition of Iran’s energetic and significant popular vote (driven in great numbers by Iranian women voters), with the cynical pageantry of the Riyadh Summit, held in a country where elections do not occur and in which women have limited freedoms, could not have been more stark.

While the Trump administration has quickly aligned itself with the particular vision of Iran espoused by Saudi Arabia and its Persian Gulf allies, the rest of the international community has watched the weekend’s events with greater pause. In the election, Iran put its best foot forward; demonstrating quite vividly that it cannot be caricatured as the destructive force portrayed by Trump, but should understood as a multifaceted country whose civil society is yearning for international engagement.

Though Trump’s speech risked adding fuel to the regional rivalry between Iran and Saudi Arabia, President Rouhani struck a measured tone in his first press conference since being re-elected, noting on Monday that the Saudi people remain Iran’s friends.

Overall, the weekend’s events may actually prove a blessing for Iran. By putting Iran’s better qualities into such clear relief, and by making so transparent the subservience of US foreign policy in the Middle East to an agenda defined by Saudi Arabia, a much wider political space is opening for ties between Iran and the wider international community, especially in regards to relations with Europe.

Senior leaders from the European Union, such as High Representative Federica Mogherini, were the first to congratulate President Rouhani on his reelection. His electoral success will no doubt give greater confidence to the slew of major multinational corporations that have been pursuing trade and investment deals in Iran. At the same time, the elections serve as a validation for the European policy that expanded economic relations can help encourage Iran’s move to a more open and accommodating political and social posture.

Consider also that despite the rhetoric, the Trump administration looks unlikely to interfere with the basic sanctions relief afforded through implementation of the JCPOA nuclear deal. As such, the baseline conditions for Iran’s economic engagement with the international business community have improved significantly.

In order to fully deliver on his promise of economic growth and to more effectively attract investment from industrial players and financial investors, the Rouhani administration must commit to a bold agenda of sustained reform. While his first term was largely focused on addressing fiscal and monetary policy (tightening budgets and reducing money supply in order to tackle inflation, for example), his second term must focus on industrial policy.

Iran needs to quickly decide how it will balance the requirement to support domestic industrialization and job creation with the need to welcome leading multinational companies who wish to bring their products to the Iranian market. A lack of clarity on this issue has meant that many long-standing trading partners in Iran are struggling to get the same support from government ministries and agencies that are afforded to outside companies promising new investment in the country.

This unequal treatment belies a lack of coordination among Iran’s government and business stakeholder groups on issues pertaining to the country’s business environment. European governments and trade promotion bodies could do much more to help transfer best-practices to their Iranian counterparts, helping to support the business development efforts of both foreign and Iranian companies. This kind of technical cooperation, which goes beyond delegations and trade events to address the practical challenges facing the business community across-sector, remains the elusive next step in Europe-Iran ties.

Rouhani’s great success has been to set the stage for an economic resurgence. The question now remains whether he can successfully direct the actors to play their parts.

Photo Credit: Wikicommons

Early Delivery of Iran Air’s First Boeing Jetliner in Doubt

◢ In early April reports suggested that Iran Air would acquire its first Boeing 777-300ER nearly a year early, purchasing a plane originally built for Turkish Airlines.

◢ But the deal now seems dead and the aircraft has not made the expected flight to Victorville, California for repainting in the Iran Air livery.

On April 10, 2017, news broke that Iran Air was to receive its first new Boeing jetliner nearly one year earlier than expected, with delivery slated for mid-May. This was to be the first aircraft of eighty for which Boeing and Iran Air signed a $16.6 billion in December 2016. Deliveries for the order, which include fifty 737 MAX 8s and thirty 777s in two variants, were slated to begin in December 2018.

The aircraft in question was originally built for Turkish Airlines with the registration TC-LJK. Deemed superfluous to requirements before delivery, the plane was to be sold by Turkish to Iran Air, where it would fly with the registration EP-IQA. Prior to reassignment, the jetliner, a Boeing 777-300ER, would need to be repainted in Iran Air colors.

This was to take place in Victorville, California, where International Aerospace Coatings (IAC), a Boeing contractor, operates a program painting liveries for 777 aircraft. Initial reports suggested that TC-LJK would fly to Victorville on April 13 for repainting, following a visit by an Iran Air certification team to ensure the Iranians were happy to acquire the jetliner in its current configuration.

But new reports suggest that the deal has stalled.

Flight data shows that TC-LJK, operating as BOE549, remains in Everett, and has not moved since a short test flight on April 7.

This suggests that the repainting has not been completed. It might be that Iran Air requested alterations to the configuration of the aircraft, which would be made at Everett and would have delayed repainting. But the more likely explanation is that Iran Air is no longer able to secure the early acquisition.

An April 22 post on Paine Field News, a blog site which tracks production of aircraft at Boeing’s Everett factory, cites an unnamed source at the manufacturer to claim that the “Turkish-Iran Air deal for TC-LJK is officially dead” and that Turkish airlines has decided to take delivery of the aircraft as originally intended.

Yet just two days prior, on April 20, the same website cited the same unnamed source to suggest that deal was still alive and that Iran Air inspection teams had visited Everett to view the aircraft.

Something must have changed in the calculation of Boeing, Turkish Airlines, and Iran Air on or around April 21.

It is worth noting that an early delivery of the aircraft to Iran Air became much more difficult on April 19, when Secretary of State Rex Tillerson made an extended address to the press in which he highlighted “Iran’s alarming and ongoing provocations that export terror and violence.” The tone of this address, and the reaction it elicited in the media, certainly meant that there would have been a heightened impact on Boeing’s corporate reputation and that of any facilitating banks had the delivery to Iran Air gone ahead in the subsequent weeks. While Boeing has lobbied that its deal with Iran Air supports American jobs, critics of the deal were buoyed by Tillerson’s apparent acknowledge of concerns over the appropriateness of US-trade with Iran, despite confirmed adherence to commitments under JCPOA.

It may be that Boeing, Iran Air, and Turkish Airlines decided to take a wait-and-see approach on the Trump Administration's rhetoric on Iran. Certainly, even if Iran Air is unable to receive TC-LJK, there remain other "orphaned" jetliners on the market which Boeing can help direct to its Iranian client. An acquisition during the summer remains possible. Given the importance of the Boeing-Iran Air deal as a landmark contract for Iran's post-sanctions trade, the race will be on to make a successful delivery.

Photo Credit: Wikicommons

Iran, Pakistan, and Afghanistan Should Take a Regional Approach to Start-Ups

◢ Start-up ecosystems in Iran, Pakistan, and Afghanistan show great promise, but entrepreneurs in these three countries remain isolated from one another.

◢ These entreprenuers would benefit from more regional programs that encourage collaboration and shared learnings. Programs on offer in the ASEAN countries offer a compelling model.

Afghanistan, Iran, and Pakistan host some of most interesting and promising start-ups in Southwest Asia. Entrepreneurship and innovation are neither new nor foreign imports to the region. Cities and towns in Afghanistan, Iran, and Pakistan make up parts of the Silk Road, an ancient network of trade routes that once connected the East and West from China to the Mediterranean Sea. Historically, trade, innovation, and cultural exchanges have flourished along these trade routes.

Today, however, the entrepreneurs of this region operate in isolation from one another. Divergent political ideologies, cultural biases, and economic policies have prevented many entrepreneurs from exchanging ideas and collaborating, rendering them unaware of their neighbors’ achievements in areas of social innovation and entrepreneurship. Knowledge sharing and transfer, if sustained, can highlight the achievements of local and regional social and tech entrepreneurs.

While these three countries engage in active trade individually, building a regional start-up ecosystem would provide a space for entrepreneurs to share their experiences and collaborate further. Because of their shared cultures, histories, languages, and similar economies, Afghan, Iranian, and Pakistani entrepreneurs already share many common characteristics that could foster more collaboration and generate more economic growth and innovation. Therefore, we propose the formation of a regional start-up ecosystem to benefit the entrepreneurs and the economies of the above countries.

Entrepreneurs and ecosystems do not operate in a vacuum. Political, social, and economic realities influence entrepreneurs and shape start-ups. Establishing a regional start-up ecosystem would reduce border tensions, improve overall regional security, promote good governance, and allow the steady flow of goods and services across the region. Meanwhile, entrepreneurs and social innovators should focus on studying and understanding their regional markets, finding opportunities for growth and scaling within their own region.

Pakistan: An Established Player

Of the three countries, Pakistan has the most elaborate and developed start-up ecosystem. Urban areas of Karachi, Lahore, Peshawar, and Islamabad are home to some of the most renowned and internationally acclaimed entrepreneurs and social innovators (e.g payload, Healthwire, Dockit, Meezaj).

Since the security climate in the country has improved, the start-up landscape has grown and attracted venture capitalists from Silicon Valley, Malaysia and the Persian Gulf. The 2012 launch of Plan9, Pakistan’s first incubator, laid the groundwork for the start-up ecosystem. Pakistan is now home to more than 20 start-up incubators and accelerators that provide co-working, office space, mentorship, networking opportunities, and access to investors.

Undoubtedly, Pakistan has the potential to become the next emerging hub in Asia. Both high mobile penetration and the well-developed telecommunication infrastructure have given rise to tech start-ups that have disrupted almost every sector—wedding, health, fashion, payments. Success stories include Convo, a social networking platform, and have captured the attention of international investors.

Shaun Di Gregorio, CEO of Frontier Digital Ventures, a venture capital fund based in Malaysia that has previously invested in Pakistani start-ups, notes that “People who have an appetite for emerging markets will be attracted to Pakistan. It’s considered one of the next big frontier markets.”

Pakistan holds an edge over its regional counterparts primarily because of two reasons. First, Pakistan’s market does not set a limit on foreign equity, enabling investors to hold a 100 percent stake without the help of any local partners. Second, total repatriation of investment capital is allowed. Therefore, every penny earned in profit can be returned to the original investor with ease.

While serving as an example for its neighbors, Pakistan’s start-up scene continues to flourish, there is still work to do. As Khurram Zafar, executive director of Lahore University of Management Sciences’ Center for Entrepreneurship, notes “more bridges are needed between Pakistan and the outside world which are best built by the diaspora looking to stay connected with the country.” This lack of connectivity can be seen in the region. Many Afghan or Iranian start-ups are unaware of the incubators or accelerators that exist in Pakistan and unsurprisingly, there are no Iranian tech entrepreneurs in Pakistan’s accelerator programs such asInvests2Innovate or Peshawar 2.0. Collaboration among these three countries would boost productivity, increase access to investment, and promote their status to emerging markets.

Iran: A Rising Star

Iran’s entrepreneurship ecosystem remains nascent yet promising. In the past decade, Iranian policymakers have shifted their focus to entrepreneurship and innovation and there is plenty of room for progress. Iran’s overall score on the 2016 GEI Index is 28.8%, ranking 80th among the 130 countries surveyed. Among the 15 MENA countries, Iran’s ranking at 14 indicates a weak entrepreneurship ecosystem. Compared to previous years, Iran’s overall score has improved, but it has yet to fully realize its potential.

In 2008, Iranian start-ups such as Digikala emerged in the ecommerce and online retail market, becoming the largest ecommerce platform in Iran. Emulating Amazon, this start-up is considered a poster child for start-up success in Iran. In recent years, fast Internet speeds, high mobile penetration, and official support for entrepreneurship have led to creation of a flourishing start-up scene.

There are many sectors that remain bursting with potential for disruption. They include ride sharing, people to people hospitality, online furniture, design services, and payment delivery. Certainly, there is high demand for these types of start-ups because of Iran’s sophisticated and young costumers, and underserved markets, a legacy of international sanctions which has now been largely removed.

Despite its low entrepreneurship and productivity scores, Iran ranks fifth after India, China, Russia, and the U.S. for having a significant number of talented and well-educated engineers. Consequently, Iranian policymakers should divert their attention fully to exploiting Iran’s impressive human resources toward boosting competitiveness, promoting employment, and raising productivity levels.

Iran’s start-up scene is vibrant led by several savvy Western educated mentors and modeled after successful Silicon Valley companies. Start up Grind and Start-up Weekend events are held throughout the country. However, there too few incubators and those which do exist often struggle to provide adequate financing opportunities to promising businesses. Accelerators exist, but few are run professionally and optimally. Unfortunately, Iranian legal codes do not protect innovation and intellectual property rights. These obstacles have created setbacks for Iranian entrepreneurs, preventing them from robust growth and scaling.

Afghanistan: Underappreciated Potential

Although Afghanistan’s ecosystem and start-up scene is only now starting to grow. Particularly in urban areas of Kabul, Jalalabab, Kandahar, Mazar-i-Sharif, and Herat, new programs are being launched teaching youth how to code, teaching entrepreneurship, and many more related programs to increase capacity, knowledge, and skills.

Among such programs are Shetab Afghanistan, the first comprehensive incubation, co-working, and mentor program in Kabul that is helping entrepreneurs and social innovators. There is also Afghanistan Startup, Startup Valley, Startupistan, and many more that are entering the Afghan start-up scene.. A 2015 survey carried out including 27 start-ups in Afghanistan revealed that 70% of Afghan start-ups fail due to ecosystem and market start-up failures, including access to mentors, infrastructure, and more open regulatory environment, and access to finance. Contrary to conventional wisdom, security is not the top concern facing entrepreneurs. Instead, entrepreneurs face the following challenges: limited access to networks and regional markets, faster internet and related infrastructure, trade friendly regulatory environment, an end to corruption, as well as availability of supportive incubation, acceleration and co-working programs. These gaps can be filled within regional frameworks.

Why Collaboration Matters

It time to put more weight on the effective implementation of new political and economic initiatives, collaborative networks, policies, and programs to regionally link start-up ecosystems across Iran, Pakistan, and Afghanistan.

The potential benefits of collaboration across regional ecosystems outnumber the disadvantages. It would lead to increased visibility and publicity for start-ups, offering an opportunity to scale into new regional markets. It would increase technical knowledge that is localized, and could potentially open up entrepreneurs from the region to sorely needed financial and mentor resources. Beyond these concrete benefits, local governments should offer incentives to attract large corporations in these countries. After all, large corporations remain vitally important for ecosystem building because they help investment in the supply chain, contract start-ups, or even possibly acquire the most promising start-ups in the long-run.

Because of the dominant Western-centric narrative widely accepted among entrepreneurs and start-up lovers, there is an overarching tendency for entrepreneurs to take examples from the West and emulate them. Therefore, there is a gap in knowledge among young entrepreneurs in these countries about exciting and new developments in their own backyard. While it is reasonable to emulate Western models, it is equally important to adopt and adjust them considering local conditions, specifically cultures, languages, and lifestyles.

For example, initiatives could include regional conferences like a TEDx talk held in Herat focusing on regional start-ups that can incorporate Tadjik entrepreneurs. Another way to foster brainstorming and collaboration among entrepreneurs could be to swap co-working spaces, as is done in Europe, so that an entrepreneur from Lahore can learn about the Iranian social technology market to scale his mobile geo-app for car parking. In addition, Iranian, Pakistani, and Afghan member investors could use shared Linked groups as a viable means to bridge cultural biases, connect board members, and enable mentor sharing between various accelerator and incubation programs in the region.

Among the most promising initiatives would be to establish a regional exchange and scholarship program between regional universities. Again looking at the region’s ‘backyard,’ the ASEAN (Association of South Eastern Asian Nations) countries have created several programs that support cross-border innovation and collaboration. For example, the very successful ASEAN University Network has helped hundreds of exchange students to study across borders since 1995. The organizations has built partnerships with other renowned universities around the world to promote knowledge sharing, collaboration, an access to opportunity through joint project-work.

Through the ASEAN Center for Entrepreneurship, regional and global initiatives support various start-ups. Recently, the Malaysian government, through its MaGIC Program, has offered ASEAN start-ups access to a regional accelerator funding and educational support services in Kuala Lumpur. Even "pariah state" North-Korea is sending its young entrepreneurs to Singapore, a powerful start-up hub, to help them in business, law, and economic policy and to learn about Lean Canvas (with the help of Choson Exchange, an NGO).

These initiatives provide compelling models of what could be done to support the achievements of local and regional entrepreneurs and social entrepreneurs among Pakistani, Iranian, and Afghan start-ups.

Unfortunately, the international media has failed to present a full and balanced view of Iran, Afghanistan, and Pakistan. Negative images of violence and terrorism have become ingrained in many entrepreneurs’ minds and rendered them oblivious to the achievements of their neighbors in the areas of social innovation and entrepreneurship. Today’s revival of the ancient trade routes as a successful model for a regional start-up ecosystem highlights not only their historical legacy, but also their contemporary relevance to regional commerce, trade, and advancement of Southwest Asia.

Photo Credit: Bourse & Bazaar

In Letter to Congress, Rex Tillerson Sends Positive Signal on Iran Deal

◢ In a letter to House Speaker Paul Ryan, Secretary of State Rex Tillerson has confirmed Iran's compliance with its obligations under the JCPOA, or Iran Deal.

◢ This letter reflects an important shift in the Trump administration's view on Iran, publicly confirming faith in verification processes and indicating an intention to craft policy through formal mechanisms.

Update: Several hours after the publishing of this piece, Secretary of State Rex Tillerson gave a press conference in which he outlined a strongly negative outlook on Iran, underscoring that the administration's review of Iran policy will take into account the full breadth of foreign policy concerns including support for terrorism and human rights violations. The statement can be seen here.

In a letter to House Speaker Paul Ryan sent yesterday, Rex Tillerson, the U.S. Secretary of State, confirmed "that Iran is compliant through April 18th with its commitments under the Joint Comprehensive Plan of Action." The letter represents the clearest confirmation to date that the Trump administration is in agreement with the international community on the fact of Iran's compliance with the JCPOA, also known as the Iran Deal.

While some outlets misreported that the letter was equivalent to an extension of sanctions relief, it is more accurately a preliminary step, part of the State Department's quarterly reporting to Congress on Iran's compliance with the Iran Deal. The critical date for the extension of sanctions relief arrives in mid-May, just prior to the Iranian presidential elections. At that point, Tillerson will need to formally "waive" the US secondary sanctions on Iran, exercising an authority delegated to him by the President.

The timing of the letter to Ryan, coming just one month before the renewals are required, is a positive signal that the Trump administration will continue to implement the Iran Deal.

To be clear, the letter was not a total break from the relatively hawkish position taken by the Trump administration towards Iran. Tillerson's missive was titled "Iran Continues to Sponsor Terrorism" and it informs Speaker Ryan that President Trump has "directed a National Security Council-led interagency review" to examine whether sanctions relief afforded to Iran is "is vital to the national security interests of the United States." The invocation of Iran as a "leading state sponsor of terror" and the reference to the pending review have led some to see the letter as consistent with President Trump's negative view of Iran and campaign rhetoric in which he described JCPOA as one of the "worst deals" ever negotiated.

However, the letter should be seen as a positive signal for three reasons. First, it is a confirmation that the Trump administration trusts established verification procedures, which include the oversight of the International Atomic Energy Agency (IAEA) and American intelligence gathering. Many opponents of the Iran deal have tried to cast-doubt on the trustworthiness of both the IAEA assessments and intelligence estimates dating to the tenure of the Obama administration, which have so far pointed to Iran's compliance with the Iran Deal. Tillerson's letter would seem to confirm that these mechanisms of evaluation hold weight for the new administration.

Second, the letter demonstrates an increasing willingness for the Trump administration to craft its Iran policy through normal channels. The interagency review requested by President Trump is a formalized and commonly-used process to determine appropriate national security policy. Given that the composition of Trump's National Security Council has changed considerably since he took office, most notably with the ouster of General Mike Flynn, who had put Iran "on notice" shortly before his demise, there is an improved likelihood that a review conducted at this stage would make a sober assessment of the Iran Deal's consistency with the US national security interest.

Finally, Tillerson's letter reflects that the Trump administration may now have a grasp on the essential challenge it is facing in crafting its policy towards Iran. On one hand, there is considerable pressure from certain congressional leaders and foreign allies such as Saudi Arabia and Israel for the administration to take a much harder stance towards the Islamic Republic. Indeed, it is worth noting that Tillerson's letter coincided with his participation in a U.S.-Saudi CEO Summit hosted by the U.S. Chamber of Commerce. On the other hand, the administration has seemingly come to understand that JCPOA is an effective foreign policy tool, one that actually addresses much of the complexity in dealing with Iran. To cease its implementation of the Iran Deal in the face of Iranian compliance would both strain relations with European allies and likely cause further destabilization in the Middle East.

For President Trump, the task will be to remain tough, but reasonable. It remains possible for the Trump administration to be tough on Iran by taking the lead on targeted sanctions designations, such as those levied for Iran's February ballistic missile test. But at the same time, it is also reasonable for the administration to continue the "suspension of sanctions related to Iran pursuant to the JCPOA," as the letter puts it, especially if such suspensions support other Trump administration priorities, such as job creation through limited US-Iran trade.

At this juncture, key stakeholders, including the leaders of American multinationals which stand to benefit from access to the Iranian market, need step-up their outreach to Trump. Encouragingly, the viability of the Iran Deal is no longer "fake news."

Photo Credit: Wikicommons

Extention of Key Incentive Scheme Boosts Iran's Renewable Energy Market

◢ The recent extension of Iran's Feed-in-Tariffs scheme has renewable energy investors pushing to close deals in the next 12 months to take advantage of the strong government incentive packages.

◢ But FiTs won't last forever, and Iranian energy authorities are working to improve the general mechanisms that support foreign investment in Iran's renewable sector, including the use of Iran's first competitive bidding tenders for renewable energy projects.

Since the lifting of sanctions, Iran’s renewable market has emerged as an exciting destination for international green energy developers and investors. Growth can largely be attributed to a generous Feed-in-Tariffs (FiTs) scheme and the government’s continued effort to promote policies that, in combination, aim to strike the right balance between promoting Iran’s renewable market, removing barriers to project deployment, and building the technical capacities of the domestic industry. By looking at some of the recent but important developments in Iran’s renewable energy (RE) market, including the nature of government policies, it becomes clear that the Rouhani administration has set a path for growth enabled by international investment.

Iran’s generous program of green subsidies has been the key determinant of the attractiveness of its renewable market, and with the government’s recent decision to maintain its current FiTs for another 12 months, the market is set to shift into a higher-gear. The extension of the FiTs scheme, which was delivered through a decree signed by the Minister of Energy in mid-March 2017, demonstrated the continued commitment of the government in sustaining the momentum of its favorable renewable energy investment landscape among many of its regional and international competitors. The consistency in the nature of Iran’s renewable policies in the last three years is by extension, a major confidence-building measure for developers and investors, whose interest in a given market is not cultivated by generous FiTs alone, but also by stable and predictable policy environment.

Interestingly, the recent extension Iran’s FiTs scheme comes at a time when in most of other markets across the globe, governments are either reducing, halting or terminating their FiTs schemes all together. This has been a major cause of concern for green developers and investors with huge vested interest in those markets. With a reduction in government incentives and flattened demand in the European market, green developers and investors are now eagerly looking into opportunities in other attractive markets. Iran comes at the top of the list.

Opportunities and Limits of Feed-in-Tariffs

The extension of Iran’s FiTs scheme presents a window of opportunity that will not be around forever, and so the countdown has already begun for developers to take advantage of the existing rates by signing their Power Purchase Agreements (PPAs) with Iran’s Renewable Energy Organization (SUNA) prior to March 2018. In light of this, it is projected that this year SUNA will expand its pipeline of renewable projects to be developed by international developers in partnership with local partners.

Currently, Iran’s FiTs scheme stipulates a 20-year PPA framework that supports a series of 13 renewable plants. The structure of the scheme is deliberately designed to increase the solar and wind capacities of the country, while also encourage procurement of smaller-scale projects by offering higher margin of profit for systems under 10MW and 30MW capacities. The reason behind this policy is twofold. On the one hand, it allows an experimental approach, where the impact of the initial projects that are pending construction and connection in this fledgling market can be assessed, and on other hand, it enables for the competence and commitment of developers to be evaluated in smaller projects prior to issuing further licenses for larger-scale developments. For the most capable developers, Iran’s FiTs system and structure simply means a strategy of portfolio aggregation—that is, building smaller projects that can be aggregated at a later stage. Therefore, many of renewable projects that will mushroom across different regions of the country in the next 24 months will consist of solar photovoltaic plants with 10MW to 30MW of capacity.

Nevertheless, the success and growth of Iran’s RE market cannot not rest on its generous FiTs scheme alone. For example, rival renewable markets, such as UAE, Jordan and Egypt, are currently developing and deploying projects on a much larger-scale than Iran without even considering the need to offer a generous FiTs scheme. For example, the launch of Dubai’s recent large-scale 200MW solar project in March, which was implemented at a record-low bid of 5.6 cents per kilowatt-hour, was product of a competitive RE tendering scheme, which is an alternative means of engaging developers.