As the Iran Deal Approaches its D-Day, Uncertainty Only Set to Increase

◢ With the United States looking set to withdraw from the Iran nuclear deal, the question now becomes how that withdrawal will take place. The European Union and Iran will face complex decisions about legal and diplomatic responses. Even though U.S. policy will be come more clear in the aftermath of May 12, the overall uncertainty facing businesses is likely set to increase.

The Joint Comprehensive Plan of Action (JCPOA) was, like many complex pieces of international diplomacy, a necessarily imperfect creation born out of compromise.

The deal is dependent for its survival on continued waivers of US secondary sanctions by the US President (a function of the congressional approval of the deal in the first place). It is also limited—quite deliberately—in the scope of its ambition: it did not seek to settle disputes concerning Iranian intervention in regional conflicts, Iran's human rights record or its ballistic missile program. And, much to the chagrin of Iran hawks in the US and elsewhere, the sunset clauses place no restriction on Iran's uranium enrichment after the first 15 years of the deal, though other aspects of the deal will be in force in perpetuity. From the Iranian side, whilst it provided relief against EU sanctions and US extraterritorial secondary sanctions, the JCPOA offered Iran no access to the US economy or, crucially, the US dollar denominated financial system.

But, imperfect as it was, it did result in the destruction of Iran's stockpile of enriched uranium and afforded the International Atomic Energy Association (IAEA) access to Iran's nuclear sites to verify continued Iranian compliance. And it has allowed Iran access to major European investment in Iran, including high profile deals struck with Airbus and French oil major Total.

In any event, some of the lingering congenital defects would not have mattered as much, or at all, were it not for other extraneous events. For example, it was always intended by the Obama administration that the JCPOA would be a starting point for further discussions and deals on other areas of difference once the nuclear boil was lanced; negotiating the nuclear settlement was lengthy enough without complicating the negotiations further by involving issues such as Syria and ballistic missiles. And continued sanctions waivers were never thought to be seriously in doubt, even as the Trump campaign gained momentum throughout 2016. The State and Treasury Department reach out sessions following Implementation Day emphasized that the political consequences of a US lead snapback would be so serious that the next President would balk at tearing it up, even if that President was a candidate who described the deal as the "worst ever."

Fix It or Nix It

Even after further criticism of the deal from the newly inaugurated President Trump, that conclusion seemed to hold good. Early forays into extending sanctions against Iran with SDN designations in February 2017 were limited in scope. They did not designate Iranian financial institutions or state owned enterprises. Indeed, they were no different in character to some of the late Obama administration's post Implementation Day Iran designations. Many concluded that moderate voices within the administration had managed to constrain the President's more hawkish impulses.

But recent personnel changes amongst the President's close advisors, and the lack of much perceived benefit from the deal in Iran, mean that the defects matter much more now. The appointment of two key Iran skeptics, John Bolton (national security advisor) and Mike Pompeo (Secretary of State) mean that President Trump now has core of foreign policy advisors in place who share his dim view of Iran deal. The President is now determined to either "fix" the perceived failings of the Iran deal or "nix" it.

There is, therefore, a very real fear that President Trump will refuse to renew the next set of waivers that are due to expire on 12 May 2018. Those waivers apply to the secondary sanctions contained in the National Defence Authorization Act (NDAA) 2012 which provides for penalties against foreign financial institutions that engage in significant financial transactions with Iran's central bank. Further secondary sanctions on the provision of significant support to Iran's energy, shipping, shipbuilding sectors or the provision of insurance and reinsurance or refined petroleum products to Iran, which apply under other congressional acts, are due to expire in July 2018 unless the waivers are renewed.

But Iran has its own JCPOA hawks, and the risk is that an abrogation of the JCPOA by the US through a failure to renew the NDAA waivers in May will provide just the excuse they are waiting for to precipitate an Iranian reaction that effectively ends the JCPOA as a meaningful deal.

Caught in the Middle

That concerns the European Union greatly. The EU sees the JCPOA as the most effective way to stop Iran obtaining a nuclear weapon, and precipitating a nuclear arms race in the Middle East that will potentially involve Gulf Arab states, Turkey as well as Israel. As the EU points out, the IAEA has repeatedly confirmed substantial Iranian compliance with the terms of the deal. More immediately, however, it could see European companies that have chosen to engage with Iran since Implementation Day exposed to US secondary sanctions for the first time.

The US did not relax its own self-denying sanctions preventing US persons dealing with Iran after Implementation Day; only the secondary sanctions affecting non-US persons. By contrast the EU lifted most of its general restrictions on trade with Iran except for those on controlled good or remaining designated persons. As a result, European companies that have been able to find means of getting paid (not an easy task when US dollar transactions are still proscribed) have engaged with Iran more enthusiastically—a fact that is no doubt not lost on a President currently jostling with the EU over aluminum tariffs. Any unilateral re-imposition of US secondary sanctions could impact these European companies significantly. The recent application of US secondary sanctions against certain Russian companies and oligarchs illustrates some of the problems that this can cause.

Historically the threat of a divergence between the US and EU over Iran has never been a problem. The two have managed to proceed in concert with each other so that US sanctions which unilaterally sought to regulate or restrict trade and investment activities carried out by persons outside the US were mirrored by the EU's own regulations and restrictions on what EU persons are able to do. But there are earlier precedents for transatlantic fallings out over the extraterritoriality of US sanctions.

In the 1980s the US imposed sanctions on companies doing business on a Russian pipeline in Eastern Europe, provoking a diplomatic falling out. And in 1996 the Helms-Burton Act, which, amongst other things, imposed penalties upon non-US persons "trafficking" in Cuban property formerly owned by US persons, provoked a furious response from the EC which launched blocking legislation and a WTO panel investigation alleging that the extraterritorial restriction of trade between the EC and Cuba breached various provisions of the GATT and GATS. The US countered that it was prepared to rely on the rarely used national security exemption in the GATT. The dispute was only withdrawn after high level political compromise.

But the prospect of a large scale transatlantic trade dispute over Iran occurring at the same time as a US-EU dispute over US aluminum tariffs and extraterritorial Russia sanctions is deeply concerning for the EU.

To that end the EU has even been looking at further potential sanctions against Iran for ballistic missile activities. The rather circular logic is that new sanctions might persuade President Trump that the EU is being tough enough on Iran to renew the waivers in May and may actually save the Iran deal. The EU recently renewed its existing human rights sanctions against Iran, which date back to 2011 and which impose asset freezes and bans on exports of equipment which might be used in internal repression. However, a recent meeting of EU foreign ministers failed to reach any agreement on the imposition of new sanctions against Iran. The clock continues ticking towards May 12.

The Dispute Settlement Process

So what would happen if the US failed to renew the waivers of the NDAA sanctions that expire in May? The JCPOA obliges the US not only to cease the application of its secondary sanctions program but to "continue to do so." A failure to renew the waivers could therefore in theory amount to a breach of the terms of the agreement. Iran could then refer the issue to the JCPOA dispute settlement mechanism, which is a largely consensual process.

The question of US compliance would first be considered by the Joint Commission established under Annex IV of the JCPOA, which consists of the participants from each JCPOA signatory (including Russia and China). The Joint Commission must make decisions by consensus, which would presumably mean that no decision would be made confirming US non-compliance (or no decision would be made within the mandated 15 days). This would then presumably precipitate an escalation to the next level; an Iranian referral of the question of US compliance to a three person advisory board. The board would consist of one person appointed by each of the US and Iran and a third independent person appointed by the first two.

The advisory board can issue a non-binding opinion on the compliance issue and must do so within 15 days. The Joint Commission will then consider the non-binding opinion for a further 5 days to try to resolve the dispute by consensus again. If the dispute has not been resolved to Iran's satisfaction, and if Iran deems the refusal to renew the NDAA waivers as "significant" non-performance, Iran could at that point treat the unresolved issue as grounds to cease performing its commitments under the JCPOA in whole or in part and/or notify the UN Security Council that it believes the issue constitutes significant non-performance.

A referral to the UN Security Council would mean that it must vote on whether to continue the sanctions relief provided by UN Security Council Resolution 2231 (2015) which endorsed the JCPOA and disapplied six previous UN resolutions imposing sanctions against Iran. Under the JCPOA dispute resolution mechanism and Resolution 2231 itself, unless the UN Security Council votes in favor of continuing the sanctions relief, the six former UN resolutions will "snap back" into force automatically. As a veto wielding permanent member of the UN Security Council, the US could, therefore, force the snap back of previous UN sanctions simply by exercising its veto.

Diplomatic Manoeuvres

There are clearly options and opportunities throughout this process for diplomacy and deal making to vary the procedure above. Whilst Iran has already hinted, most recently through its Foreign Minister Javad Zarif, that it would probably react by restarting production of enriched Uranium, it might nonetheless choose to use the fact that some of the waivers expire in May and others in July to bide its time before actually withdrawing from the deal.

It could perhaps choose to take the process through the Joint Commission and advisory board stages, until it reached a point at which it could claim that the unresolved dispute was US non-performance. That point would be reached in mid to late June. It could then refrain from referring the dispute to the Security Council and perhaps even confirm its continued performance (for the time being) despite the lapse of US waivers in May. That would avoid an automatic "snap back" of UN sanctions, or the risk that the US could treat an Iranian abrogation as non-performance and refer the matter to the Security Council itself.

Iran could then utilize the remaining weeks before the next US waivers expire to rally support from concerned EU signatories, perhaps even relying on a potentially positive advisory board opinion, to garner diplomatic sympathy for its position. It would then have a further opportunity to go through the JCPOA dispute resolution process in July if those diplomatic efforts failed and the other waivers were not renewed.

Of course, it is equally possible that Iran's own hardliners gratefully accept any failure to renew waivers in May as the excuse that they have been waiting for to finally tear up the deal. No-one can rule out a last gasp left-field intervention from the US President himself that changes everyone's calculations.

No doubt such diplomatic brinksmanship will cause investors and exporters to Iran to be reaching for their contracts and examining any "snapback" provisions. Would a limited US re-imposition of NDAA secondary sanctions, in the absence of any other secondary sanction re-imposition—let alone any EU sanctions or UN sanctions—constitute a "snapback?" The answer, of course, will depend on what sort of trading relationship is concerned and how the actual clause is drafted. Some are drafted very mechanically requiring specific events to occur; others are more subjective and only require one party to reasonably consider their position is affected by unspecified sanctions. As ever, close attention is required before making any decisions about terminating contracts.

But it is clear that the coming weeks and months will be a rollercoaster ride for all affected.

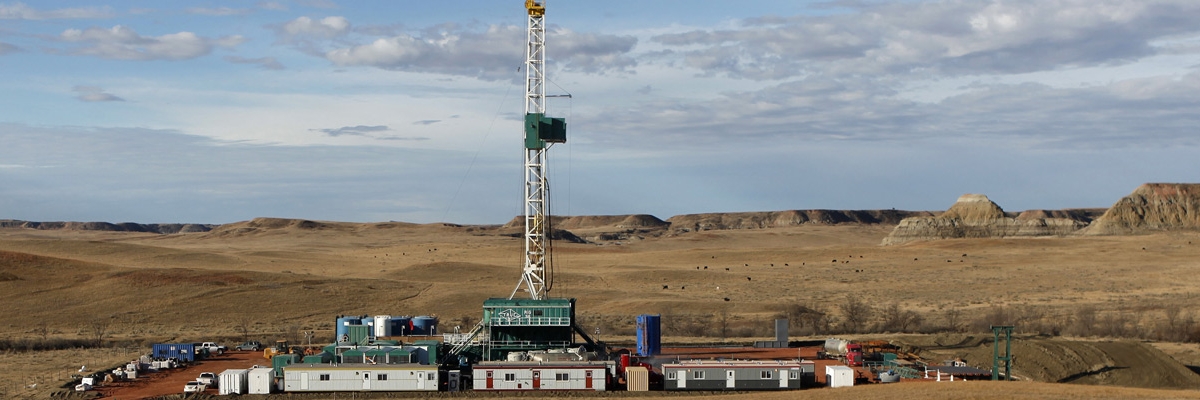

Photo Credit: Wikicommons

Macron and Merkel Must Flex Muscles to Save Iran Nuclear Deal

◢ The forthcoming visits to Washington by French President Emmanuel Macron and German Chancellor Angela Merkel come at a time of great importance for the Iran nuclear deal, regional security, and transatlantic relations. European policymakers are considering credible ways to signal that the EU is willing to take action if confronted with U.S. withdrawal from the deal, but a significant resolve will be needed.

This article is adapted from a recent report from the European Leadership Network.

The fate of the international nuclear agreement with Iran, known as the Joint Comprehensive Plan of Action (JCPOA), looks increasingly uncertain in light of repeated attacks from U.S. President Donald Trump, who has threatened to walk out of the deal unless Congress and European counterparts agree to “fix it.” The recent appointments of Mike Pompeo and John Bolton—both vocal critics of the JCPOA and widely seen as staunch hawks on Iran—make it less likely that Trump will keep the United States in the deal at his next decision point by 12 May. Faced now with the likelihood of U.S. withdrawal, Europe must decide how far to go to try to preserve the agreement in the face of renewed U.S. sanctions.

Against this backdrop, the forthcoming visits to Washington by French President Emmanuel Macron and German Chancellor Angela Markel come at a time of great importance for the nuclear agreement, regional security, and transatlantic relations. Macron’s meeting with Trump will be of particular significance, given the good rapport between the two leaders. Syria will likely feature at the top of the agenda, but the visit will offer an urgent opportunity to remind President Trump of the importance of the nuclear deal for his European allies.

U.S. decision makers can still be influenced. Washington’s position on the nuclear deal is far from monolithic and it is still possible that President Trump could be influenced by congressional opinion, which remains sensitive to European concerns. There is no congressional majority for a unilateral U.S. withdrawal from the JCPOA while Iran remains compliant, still less for the re-imposing secondary nuclear-related sanctions on European allies. Even if the United States decides to leave, some main provisions of the deal might still be kept.

This leaves plenty of scope for European intervention. Representatives of the European signatories of the JCPOA, the so-called E3 (Germany, France, and the United Kingdom), are currently engaged in consultations with their U.S. counterparts to save the agreement. This includes discussions on how to accommodate President Trump’s concerns over the deal’s inspection provisions and “sunset clauses,” as well as over Iran’s missile programs and regional activities. But European leaders are also making clear that they will not just fall into line if Washington decides to leave the agreement and re-introduce sanctions.

A re-introduction of sanctions does not necessarily equate to a full re-introduction of all U.S. sanctions without exemptions. American policymakers can calibrate the sanctions they choose to re-instate and the executive powers of the president in matters of national security add to this flexibility. This means that there is plenty for Europeans to negotiate for with their U.S. counterparts about the terms of any U.S. withdrawal. It is possible to envision a transatlantic quid pro quo in which U.S. secondary sanctions are waived even if the United States leaves the agreement.

The risks of a U.S. withdrawal and a comprehensive snap back and enforcement of secondary are nonetheless tangible. As a result, European policymakers are considering credible ways to signal that the EU is willing to take action if confronted with this scenario. This includes reviving EU “blocking regulation” (which seeks to prohibit EU persons from complying with U.S. secondary sanctions or acknowledging the jurisdiction of non-EU courts or authorities with respect to those sanctions) and filing complaints at the World Trade Organization (WTO).

There are significant and inherent risks with these options. These retaliatory measures could easily escalate into an unpredictable and unmanageable tit-for-tat. This would not only impose significant costs on the EU and cause serious friction in the transatlantic relationship but also do damage to the institutions that uphold the free movement of goods, services, and ideas – bedrocks of the multilateralism the EU cherishes. After all, pushing back against the United States requires political will. And while there is undivided support for the JCPOA within the EU, there is little appetite for further confrontations with the United States.

Notably, this could change if Washington is seen as taking further steps to undermine transatlantic relations and European interests. An already fractured partnership is sensitive to further blows – for instance if the United States would go ahead and impose tariffs on European exports after the temporary exemptions on EU steel and aluminum exports expire on May 1.

The wider international context in May is therefore going to matter a great deal for the fate of the JCPOA. So too will the way that the Europeans choose to frame their differences with Washington over the deal. A choice between the JCPOA and good relations with Washington is one thing; the ability of the EU to maintain its security, its autonomy and the values it thinks should define the international order is quite another. The latter would merit a tougher stance.

Still, an inconvenient truth remains—no EU action can completely shield European businesses and investments in Iran. In this sense, there is no bulletproof defense of the JCPOA’s economic benefits in the event of a U.S. withdrawal. The EU and its member states can pursue measures to shield existing links, encourage further business activity and boost investors’ confidence in the Iranian market, but while government can facilitate business, it cannot control it.

Consider the lingering caution of financial institutions despite sanctions relaxation under the JCPOA, which is a sobering reminder of the challenge of steering the private sector through Iranian market obstacles. As the chief legal officer at HSBC noted in response to the Obama administration’s push to encourage European banking activity in Iran, “Governments can lift sanctions, but the private sector is still responsible for managing its own risk and no doubt will be held accountable if it falls short.” In light of the current uncertainty surrounding President Trump’s policy towards Iran, private sector actors will have plenty of reasons to be wary of the Iranian market. This will continue to restrict investment for the foreseeable future.

As a result of struggles with financing, major businesses are canceling or scaling back their planned activities in Iran. Airbus is struggling to complete its sales of Aircraft to Iran; Total, the French energy giant, is deep into contingency planning for its Iranian operations; and Bouguyes, a French industrial group, has decided to put their Iranian plans on the shelf. As noted in a recent Bourse & Bazaar study, this risks dragging the JCPOA into a “zombie state.”

Europe nevertheless has realistic options in the face of a U.S. withdrawal. There is a strong commercial interest in engaging with Iran, and European policymakers can promote policies that help turn interest into action. They need not—indeed, should not—put all their eggs in one basket but should pursue an array of options in parallel. This includes solidifying international support for the JCPOA, demonstrating that re-imposing sanctions unilaterally will come at a cost for the United States, seeking U.S. exemptions for European businesses to continue operating in Iran, and bolstering international business confidence in the Iranian market. Such practical steps, taken now, can bolster European negotiating leverage with Washington, send useful signals to Tehran and strengthen European political will to defend the JCPOA.

Photo Credit: Armando Babani/EPA

Iran’s Energy Sector Takes Stock After Year of Ambivalent Results

◢ The last Iranian year, which ended in March, saw several interesting developments for Iranian energy, both domestically and internationally. Despite persistent challenges, Iran is keen to build on the momentum of last year’s developments. In doing so, the question of whether the Trump administration will stay in the JCPOA and renew sanctions waivers on May 12 will have great importance.

This article was adapted from a report originally published by the Oxford Institute for Energy Studies.

The last Iranian year, which ended in March, saw several interesting developments for Iranian energy, both domestically and internationally.

Numerous challenges remain, hampering the growth of the country’s energy industry – not the least due to complex politics in Iran and abroad. In particular, Iranian energy is overshadowed by mounting uncertainty due to the standoff over the future of the nuclear deal. Nevertheless, there has been progress not seen in years.

Internationally, Iran commenced natural gas exports to Iraq in June 2017. This was Tehran’s first successful natural gas export project in over a decade.

Moreover, Tehran concluded its first two international energy contracts following the introduction of a new fiscal scheme, the Iran Petroleum Contract (IPC), and the implementation of the Joint Comprehensive Plan of Action (JCPOA), as the nuclear deal is formally known.

In July 2017, Petropars formed a consortium with French major Total and China’s to develop the eleventh phase of the giant South Pars natural gas field. In March 2018, the National Iranian Oil Company concluded a contract with Russia’s Zarubezhneft and private Iranian company Dana Energy to increase output at the Aban and West Payedar oil fields.

These events constitute important milestones on Iran’s journey to re-connect with global energy. At the same time, it would be wrong to assume that the obstacles hampering the growth of Iran’s energy sector are now overcome—not only because of Trump and the uncertain future of the JCPOA.

Rather, in each of these cases, the circumstances have been rather unique. As for Iraq, close political ties with Baghdad allowed for the project to succeed. This distinguishes the Iraq project from other export plans, where political and commercial issues remain complicated—for example Oman and Pakistan (ongoing) or the United Arab Emirates (in the early 2000s).

Shortly after natural gas exports to Iraq commenced, the Total/CNPC contract was signed. But here, too, the circumstances are rather unique. First, the company has a long history with Iran and the complicated international politics accompanying the country’s energy sector. Already in the 1990s, the French company’s planned engagement in Iran played a key role in the EU’s action to push back against extraterritorial US sanctions. These were introduced by Washington under the 1996 Iran and Libya Sanctions Act (ILSA). In response to ILSA (as well as US extraterritorial sanctions against Cuba), the EU introduced so-called “Blocking Regulations” legislation and filed a dispute against the US at the World Trade Organisation.

The EU’s moves forced the Clinton administration into adopting sanctions waivers, which suspended the implementation of US secondary sanctions and allowed Total to proceed in Iran. Ever since, despite being forced to leave the country in 2010 due to EU sanctions, Total has remained committed to Iran, openly criticised sanctions against the country, and always kept its office in Tehran open—different from other companies.

Second, Total is able to bring its own finance to Iran. The company affords the initial $1 billion investment from its own reserves. With the reluctance of major international banks to return to Iran, fearing punitive measures by the US, finance for large projects remains a huge problem. Being able to bring its own finance sets Total apart.

Last but not least, Total is investing in Iranian natural gas, not oil. In the political economy of Iranian energy, the two hydrocarbons differ markedly. More than half of Iran’s oil production is exported, while less than 5% of the country’s natural gas output is sent abroad. An advancement of Iranian natural gas capacities frees some oil for exports. But the link between increases in production and export revenue is much weaker. Thus, investing in natural gas does not immediately lead to more hard currency at the disposal of the Iranian state.

In light of this, a case can be made that investments in Iranian natural gas projects are more acceptable to Washington than oil. At any rate, both before and after the conclusion of the South Pars contract, Total has frequently acknowledged the importance of the US position for its engagement.

Iran’s second international energy contract, with Zarubezhneft, was particular, too. It combined two firsts in one contract: the deal marked Iran’s first upstream contract with a Russian company and also the first international contract awarded to a private Iranian company, Dana Energy.

Beyond this, the deal is further testimony to the fact that Zarubezhneft, controlled by the Russian government, seems unimpressed by the Trump administration’s harshening stance towards Iran. Unlike Western IOCs, Russian (and also Chinese) state-owned companies might benefit from being able to take a different position when it comes to assessing political and economic risks related to Iranian energy.

The significance of different risk-assessments cannot be underestimated: Iran’s energy sector continues being surrounded by multiple and complex political and economic challenges. These include ample supplies in global energy, efforts by conventional producers to keep barrels away from markets, domestic political opposition to international and especially Western companies in Iran, and—almost overshadowing everything else—the prospect of the US leaving the JCPOA.

Parallel to the ups and downs at the international level, the domestic politics of Iranian energy saw interesting developments, too. In January 2018, Supreme Leader Khamenei reportedly told the Revolutionary Guards (IRGC) to divest from those parts of their wide-spanning business conglomerate that are “irrelevant” to their core purpose. If followed up by meaningful action, this would have wide-ranging consequences for Iran’s energy sector, where the IRGC maintain a considerable presence.

However, several economic and political questions in this regard remain unresolved until now. Politically, it will need to be defined which of the IRGC’s economic activities are actually considered being “irrelevant." Arguing Iran should reduce international dependencies, conservatives might call for the IRGC to maintain a certain presence in strategically vital sectors, including energy. Economically, it is unclear who could actually take over businesses from the guards. Considering the sheer size of the IRGC’s economic holdings, Iran’s private sector seems unprepared to stem a larger IRGC divestment. Meanwhile, foreign ownership remains highly problematic in Iran.

All this suggests that IRGC divestment from the energy sector and the broader economy would at best be slow and gradual. Somewhat, the process has already begun as the administration of president Rohani reduced the number of public contracts awarded to the IRGC in recent years. Still, the IRGC have yet to indicate their willingness to actually divest. It would therefore likely take years until the IRGC have meaningfully reduced their economic profile.

Moving forward, Iran is keen to build on the momentum of last year’s developments. In doing so, the question of whether the Trump administration will stay in the JCPOA and renew sanctions waivers on May 12th will have great importance.

At the same time, a withdrawal of the US from the JCPOA and the re-imposition of nuclear-related US sanctions would not immediately bring Iran back to its pre-sanctions position. In particular, it is unlikely that Tehran’s oil exports would collapse to pre-JCPOA levels.

Europe’s role is crucial here: As long as Tehran fulfils its commitments under the JCPOA, the EU is unlikely to bring back its energy and finance sanctions against Iran. These, however, were deceive in forcing down Iranian oil exports by more than half after 2012.

Some Asian countries, most likely Japan and South Korea, might voluntarily reduce parts of their imports of Iranian oil. But without Europe joining the sanctions effort, the re-imposition of US nuclear sanctions is unlikely to dramatically affect Iranian oil exports.

Nevertheless, if the US decides to withdraw from the JCPOA on May 12th, this would obviously still hit Iranian energy hard. Very likely, it would effectively prevent further European IOCs from engaging in the country—and thereby significantly hamper the growth of Iran’s energy sector.

Photo Credit: AP/REX

For Iran Warehouse, ‘Unglamorous’ Logistics Real Estate Offers Resilience and Returns

◢ The logistics industry in Iran is burgeoning with international players such as DHL Freight and Maersk Line connecting Iran's supply chains to the world. But Iran's logistics infrastructure remains underdeveloped. Iran Warehouse is making a big bet on logistics real estate and is building Iran’s first true Grade A warehouse park—a 60,000 square meter development in West Tehran.

Coco Ferguson first saw the potential in logistics real estate in East Africa, where as a co-founder of Nairobi-based Maris Limited, she raised USD 60 million to fund the development of Kenya’s first “Grade A” warehouses. Now she wants to replicate that success with Iran Warehouse, a company she founded alongside Nader Sianaki, whose family developed some of Iran’s first modern warehousing seventy-five years ago.

The logistics industry in Iran is burgeoning. International players such as DHL Freight and Kuehne + Nagel are connecting the Iranian market to the world by land, while Maersk Line and MSC create new links by sea, facilitating the significant increase in the variety of foreign goods available in Iran since the lifting of international sanctions in January of 2016. The rise of e-commerce has also led to significantly more demand for timely and reliable logistics and distribution services.

Despite these new entrants, Iran’s logistics real estate remains greatly underdeveloped. The World Bank began ranking global logistics infrastructure in 2007 with the Logistics Performance Index. The index looks at five factors: timeliness, customs, infrastructure, international shipments, competence, and tracking. The world’s top ranked country is Germany. Iran ranks 96. Though infrastructure is one of Iran’s stronger categories, its score of 2.67 is significantly below Germany’s score of 4.44. A lack of warehousing is one major reason for the shortfall.

Ferguson and Sianaki estimate that Tehran alone needs 2-3 million square meters of Grade A warehousing space. Current capacity is just 10 percent of that amount. Iran Warehouse has ambitious plans to fulfill latent demand and change the face of what Ferguson calls an “unglamorous sector.”

The company has raised 80 percent of an initial EUR 10 million funding round from a combination of European investors and Iranian banks in order to develop Iran’s first true Grade A warehouse park—a 60,000 square meter development in West Tehran, located near the junction between the Azadegan Expressway and Fath Highway. The company currently operates a 6,200 square meter facility in Shurabad. Further sites are under planning.

Iran Warehouse is entering a sector characterized by fragmentation and inefficiency. Nearly all warehouses in Iran are owner-occupied, bucking the international norm. Manufacturers and logistics firms around the world typically seek to avoid the cost and hassle of owning their own warehouses, opting instead to lease space from logistics real estate firms. The world-leading logistics real estate company is San Francisco-based Prologis, which oversees a portfolio assets worth USD 79 billion. The Chairman and CEO of Prologis is Iranian-born Hamid Moghadam. One of Europe’s largest logistics real estate companies with 630 properties, Logicor, is also led by an Iranian, Mo Barzegar.

But in Iran itself, commercial enterprises treat real estate assets as a hedge against volatility and risk. Banks have also been historically reluctant to provide loans to enterprises without real estate collateral. The incentives for companies to own their own warehouses are clear.

Owning real estate does not however mean that Iranian logistics companies value it. A 2018 study by researchers at the Iran University of Science and Technology surveyed 119 Iranian logistics providers, who were asked to rank key success factors in their industry from one to five, with five being the most important. Just ten respondents gave “fixed assets” which includes warehousing facilities, the highest score of five, while 47 respondents scored fixed assets at one. It is fair to assume that logistics providers have a limited appreciation of the additional costs and lost efficiencies represented by the current configuration of logistics real estate in Iran.

Even Iran’s largest companies often make do with numerous small warehouses, which requires them to take-on additional staff and equipment for each site. Ferguson believes that companies in Iran are paying a 30 percent premium on overhead because of such configurations. Add to this the additional costs of inventory management and distribution from multiple centers, and overall logistics costs are probably 60 percent higher than would be the case for a company with access to a well-located and professionally-managed warehouse. The additional cost is passed onto the consumer, creating wider economic consequences.

For Iran Warehouse, these high costs present a unique opportunity. Ferguson acknowledges that Iranian companies have ingrained habits, but cites early success in demonstrating to potential clients how upgraded logistics infrastructure and professional third-party management can unlock value.

The company has partnered with Niktak Freight Forwarders and Shipping, the Geodis agent in Iran, to provide distribution services in addition to the operation of its warehouses. Turn-key solutions have seen Iran Warehouse win 5-7 year leases from clients, rather than the one-year leases that have been commonplace in the warehousing market.

A rendering of Iran Warehouse's planned 60,000 square meter facility

For investors, warehouses may not seem like the most appealing assets, but Ferguson thinks those looking at Iran often overthink their strategies. “Iran is seen as a high risk market, and so investors naturally gravitate towards high-risk, high-reward businesses,” she notes. “Investors tend to ignore the very low risk opportunities in an area such as warehousing.” Warehouses, unlike other forms of real estate, can be built in phases as clients are found, limiting the risk to upfront capital.

While Ferguson expects to generate conservative returns of 15-18 percent for her investors, she notes that Iran Warehouse’s revenues are tied to contracts indexed to the Euro, eliminating exposure to volatility in foreign exchange. Given that Iran’s currency has lost over 30 percent of its value over the last year, an insulated 15 percent return is inherently attractive.

Moreover, the Iran Warehouse business model is not dependent on new companies entering the Iranian market. With political uncertainty having limited the number of new multinational companies entering Iran’s consumer markets in the last year, history shows, Ferguson believes, that the global FMCG companies currently active in Iran “are definitely sticking around.”

By focusing on the storage and handling of food and finished goods, rather than industrial products, Iran Warehouse will enjoy consistent demand however the political tides may turn. The anchor tenant for the company's new facility is global food and beverage giant Nestle, which has been operating in Iran through its local subsidiary for 15 years.

Ferguson observes that a lot of the current real estate development in Iran will necessarily require further development in warehousing: “There are 65 shopping malls being built in Tehran,” she says. “But I don’t know of a single major third-party warehousing development to actually hold the goods that are going to go into stores. Without development on the logistics side, distribution costs will remain unreasonable.”

Moreover, as zoning in Tehran is changed to reduce congestion, many smaller warehouses located in what are now centrally-located neighborhoods are being converted to residential or retail developments. Tehran Municipality therefore has an interest in seeing consolidation in logistics real estate. Newly constructed warehouses will often be situated in Tehran’s traditionally blue-collar outskirts, which have seen factories relocate further afield, to places like Qazvin. These new facilities will bring much-needed jobs. Iran Warehouse’s Azadegan site will create 250 jobs when fully developed.

A huge proportion of Iran’s economic potential remains unrealized simply because of the inefficient configuration and use of existing resources. World-class investments in logistics real estate, though unglamorous, could prove one of the most fundamental ways to create economic value. For Ferguson and Sianaki, who look upon Iranian-led Prologis and Logicor as models to emulate, the challenge is to “bring that winning mentality home.”

Photo Credit: Iran Warehouse

In Confirmation Hearing, Pompeo Unwittingly Makes Strong Case for the Iran Nuclear Deal

◢ During confirmation hearings yesterday, Secretary of State nominee Mike Pompeo sought to ensure the members of the Senate Foreign Relations Committee of his deep commitment to diplomacy, even in the case of Iran. But committee members were well-prepared, challenging Pompeo on his record of hawkish statements. To defend himself, Pompeo was forced to defend the JCPOA as he struggled to stick to the administration's illogical talking points.

Mike Pompeo is eager to be Trump’s new Secretary of State, a position that would offer the former Kansas congressman a public profile far greater than he enjoyed as director of the Central Intelligence Agency. Pompeo wants to represent America on the world stage and to restore the “swagger” of the Department of State.

His eagerness shone through as the nominee was questioned on his views regarding the Joint Comprehensive Plan of Action (JCPOA) by members of the Senate Foreign Relations Committee yesterday. Republican and Democratic members alike were ready with sharp questions as Trump’s self-imposed May 12 deadline for a “fix” to the deal loomed.

During the hearing, Pompeo was obliged to navigate his record of hawkish statements on Iran and the nuclear deal, his need to show ideological consistency with the President (without which his tenure as Secretary of State would surely be short-lived, as Tillerson’s experience showed), and his need to demonstrate a character befitting America’s lead diplomat. Pulled between these three obligations, Pompeo confused his talking points, struggled to dodge his record of hawkish and bigoted statements, and sought to seem reasonable the one way he could—by making a strong case for the Iran nuclear deal.

The cracks in Pompeo’s thinking first appeared as Arizona senator Jeff Flake began a line of questioning focused on the economic benefit Iran had received from the JCPOA. Flake observed, “In effect Iran has already realized much of the benefit of the agreement, but if we were to exit the agreement now, we would give them reason to renege on the agreements they have made nuclear side.”

The question put Pompeo in a bind. The Trump administration has been vocal about the economic pressure it has placed on Iran. Yet, as Flake’s questions sought to establish, the economic dividend of the deal is the source of American leverage to maintain Iranian compliance.

Flake asked whether there exists any means to claw back money received by Iran to date in the event of an American withdrawal from the agreement. There is no such means, Pompeo conceded, exposing that withdrawal from the JCPOA will mean forgoing significant leverage to prevent Iranian proliferation. Iran would have nothing to lose.

Pompeo, sensing the point about leverage, agreed that Iran has “received great economic benefit from the JCPOA” and that there remains “continued interest on the part of Iran to stay in this deal. It is in their own economic self-interest to do so.”

Senator Flake gets Pompeo to concede that Iran presents a low proliferation risk

But to deflect the concern about a loss of economic leverage in the face of a proliferation risk, Pompeo took a surprising tact, claiming “Iran wasn’t racing to a weapon before the deal, there is no indication that I am aware of that if the deal no longer existed that they would immediately turn to racing to create a nuclear weapon.”

Pompeo did not hold this belief until recently. In 2012, when he criticized the Obama administration's assessment “that the Iranians have not yet decided to build a bomb,” saying at the time, “To me, these words are reminiscent to those of Neville Chamberlain.”

In now downplaying Iran’s ambition to proliferate to Senator Flake, Pompeo undermined his earlier testimony, given in response to questions asked by Senator Bob Menendez, in which the nominee described the urgent need to “fix” the nuclear deal. After all, if Iran is not hellbent on acquiring a nuclear weapon, and was not seeking such a weapon prior to the deal coming into force, then surely the concern over “sunsets” is overblown.

This inconsistent logic reveals who has been advising Pompeo on Iran policy. A recent Washington Post op-ed by Reuel Gerecht of the Foundation for Defense of Democracies, written with Ray Takeyh of the Council on Foreign Relations, makes precisely the same argument. Gerecht and Takeyh write that “there’s no need for hysteria” if Trump abandons the nuclear deal, because “the Islamic Republic still isn’t likely to run amok, ramping up its nuclear program” given technical and political limitations. Pompeo is known to lean on FDD analysis, and participated in a summit organised by the hawkish think tank in October of last year.

Pompeo further contradicted himself on the matter of Iranian proliferation when pressed on Iran’s verifiable compliance with the Iran nuclear deal by New Mexico Senator Tom Udall.

Senator Udall pushes Pompeo on Iran's proven compliance with the JCPOA

Udall read a past statement by Pompeo expressing concern about the expiration of the JCPOA and the so-called “sunset clauses.” Pompeo had previously stated that “Iran will have the freedom to build an arsenal of nuclear weapons at the end of the agreement.”

Udall pointed out that in addition to its commitments under the JCPOA, Iran is also a signatory to the NPT and abides by the IAEA Additional Protocol, the commitments of which Iran has agreed to in perpetuity. He then asked Pompeo whether he had seen any evidence that Iran had not complied with its commitments under the JCPOA. Pompeo’s response was clear: “With the information I have been provided, I have seen no evidence they are not in compliance today.”

When Pompeo was read his own 2014 statement, in which he suggested that a military solution would be easier than a negotiated agreement to halt Iran’s nuclear program, he feebly replied “I don’t think that is what I said that day” before seeking to reassure members of the committee that he believes the “solution to preventing Iran from getting a nuclear weapon… is through diplomacy.”

Whether or not Pompeo’s newfound interest in diplomacy is genuine, it is clear that he is wary of the potential chaos that may follow Trump’s abrogation of the deal. Echoing another FDD talking point, Pompeo claimed that diplomatic efforts to “achieve a better outcome and better deal” could continue “even after May 12.”

The notion that the U.S. could continue to pursue diplomacy, and even remain in the deal, even after Trump opts not to further waive secondary sanctions on May 12, reflects the “fix not nix” approach devised by FDD which seeks to prevent American responsibility for the deal’s demise. Tellingly, Treasury Secretary Steven Mnuchin made a similar statement this week, claiming that “If the president decides not to sign [the waivers], it doesn’t mean we’re necessarily pulling out of the deal.”

Pompeo, after years of saber rattling, seemed willing to give diplomacy a chance. But committee members could see clearly that Pompeo’s testimony was first and foremost about giving himself a chance for confirmation. For Pompeo the verifiable success of the JCPOA is nothing more than an inconvenient truth to be acknowledged briefly now and then denied vociferously later.

Photo Credit: Bourse & Bazaar

Trump Stance on JCPOA Nuclear Deal Poses Legal Dilemmas for Iran

◢ With the May 12 deadline for the issuing of key sanctions waivers as part of the Iran nuclear deal fast approaching, the legal impact of the collapse of the 2015 agreement ought to be considered. Regardless of how Iran responds to a change in U.S. policy, the possible withdrawal of the United States from the JCPOA will have a legal impact on its parties. Any possible change in the partnership or the provisions of the agreement will be reflected within the domain of international law.

With the May 12 deadline for the issuing of key sanctions waivers as part of the Iran nuclear deal fast approaching, what could be the impact of the collapse of the 2015 agreement? While Donald Trump's conditions for the review of the current arrangement have yet to be met and Iran's clear rejection of any amendments to the plan, the breakdown of the Joint Comprehensive Plan of Action (JCPOA) seems inevitable.

The nuclear deal is the most important multilateral agreement reached in the global nuclear non-proliferation system in the last decade. It is now at risk of collapse. There are three options for Iran should the US withdraw from the JCPOA.

First, Iran could exit the deal immediately and continue to fulfill the obligations under NPT and to the IAEA based only on the safeguard agreements with the agency. This is seen as the worst case scenario by the EU, E3 and the IAEA.

Second, Iran could exit the deal immediately, but continue to fulfill its commitments to the International Atomic Energy Agency (IAEA) based on both safeguard agreements with the IAEA agreed as part of the JCPOA and its preceding agreement, the Joint Plan of Action (JPOA). Under these safeguards Iran has suspended enrichment of uranium to 20 percent.

Third, Iran could opt to remain in the deal on the basis that the European Union and E3 (UK, France and Germany) will provide additional benefits to Iran to compensate for the negative effects of US withdrawal.Iran’s deputy foreign minister, Abbas Araghchi, one of the key architects of the JCPOA, has stated that as long as Iran continues to benefit from a removal of sanctions, it will remain committed to the deal, but has expressed doubts that the France, Germany and the UK will be able to guarantee Iran’s interests in the absence of the United States.

Regardless of which route Iran takes, the withdrawal of the United States from the JCPOA will have a legal impact on its parties. Any possible change in the partnership or the provisions of the agreement will be reflected within the domain of international law.

The Threat of Snapback

Trump has threatened not to issue the crucial waivers that have suspended US secondary sanctions on Iran. On May 12, Iran may find itself in a position not of its own making. Despite unprecedented international monitoring and scrutiny of its nuclear program, and despite the IAEA's approval of its commitments without the slightest deviation for military purposes, it may once again face significant economic sanctions, even over the vital sale of its oil. However, snapback of US secondary sanctions could actually preclude snapback of UN sanctions, if the deal remains intact following Trump’s withdrawal.

One of the provisions of the JCPOA, unprecedented in the 70-year history of the Security Council, is the decision-making process of the partners required to resume sanctions. According to Article 37 of the JCPOA, if the dispute resolving mechanism is unsuccessful, the UN Security Council will vote on a resolution to continue the lifting of sanctions.

In such a case, the United Nations Security Council would vote for a resolution to suspend sanctions. As described in a recent report by Stephen Mulligan, an attorney with the Congressional Research Service:

The ‘snapback’ mechanism thus places the onus on the Security Council to vote affirmatively to continue to lift its sanctions by stating that those sanctions will be implemented automatically unless the Security Council votes otherwise. As a permanent member of the Security Council, the United States would possess the power to veto any such vote and effectively force the reinstatement of the Security Council’s sanctions on Iran.

In this process, the vote of all five permanent members of the Council is critical. If one of these members does not agree with the suspension of sanctions, it alone can easily restore a series of Council sanctions under Article 41 and Chapter 7 of the United Nations Charter (threats to global peace and security).

However, if the United States pulls out of the JCPOA, triggering the snapback of its secondary sanctions against Iran, it may lose the ability to use the UN sanctions snapback threat which is articulated with Article 37 under JCPOA. In other words, only parties to the Iran deal are able to trigger the UN nuclear sanctions snapback procedure. If the US withdraws from the deal, it loses the ability to trigger this mechanism.

This would be a reprieve for Iran, but there are further legal pathways that should be considered in order to prevent more damages by the US to the non-proliferation regime and international law.

Recourse to the International Court of Justice

The IAEA has verified in eleven reports that Iran has fully complied with its commitments under the nuclear agreement. On this basis, Iran feels it is facing punishment without justification.

Iran can, on the basis of Clause 2 of Article 21 of the Treaty of Amity, Economic Relations, and Consular Rights (1955), file a complaint with the International Court of Justice (ICJ) against the United States on the basis that it has had a detrimental effect on its business and trade with other countries.

Punishing Iran with various economic sanctions, including the vital sale of its oil, may result in Iran’s withdrawal or limited implementation of its political commitments under JCPOA. Depending on whether Iran completely abandons JCPOA or suspends some of its commitments under the agreement, it means the end of the current inspections and the IAEA's ability to continue a complete and unprecedented monitoring of Iran's nuclear program. The result is the inability of a United Nations agency to carry out its mission.

The current situation has created a legal impediment, despite the wishes of Iran, for the IAEA and the members of its board of governors including the United Kingdom, France and Germany. According to the definition of the Vienna Convention on the Law of Treaties 1969, the JCPOA is not considered to a treaty, under which definition a violation would result in a case directly taken as a complaint to the International Court of Justice.

However the IAEA is an agency authorised by the UN and if it cannot reciprocate with its obligations to a UN member state that has been in compliance with the nuclear agreement (Iran) due to the interference of a third country, the IAEA can, on the basis of Article 96 of the UN Charter, and Clause 1 of Article 65 of the Statute of the International Court of Justice, for the first time in its history, resort to the ICJ for an advisory opinion on the legal status of the JCPOA.

There is some precedent for such a request by an international organization like the IAEA. The World Health Organisation has taken a similar action on threats to the use of nuclear weapons in armed conflict, requesting a referral from the International Court of Justice. The ICJ’s response would not be legally binding but it would be a new source of international law, and may be considered by the other parties to the nuclear agreement as an official advisory about their treatment of deadlock with the United States.

The JCPOA is an improbable achievement, an agreement reached after Iran had been subjected to the harshest sanctions regime ever imposed. In political practice and in the domain of international law, the JCPOA provides a new way of resolving disputes in support of the nuclear non-proliferation regime. the agreement collapses it would be, as in the words of Yukiya Amano, Director General of the IAEA, a “great loss for nuclear verification and for multilateralism” and in my view also for international law more generally.

Photo Credit: Wikicommons

Rouhani Government Unifies Iran’s Exchange Rates in Decisive Move to Stabilize Currency

◢ In a decisive move intended to stop the further devaluation of the rial, the Rouhani government announced it would unify the official and free market dollar exchange rates, settling on an official rate of IRR 42,000. First Vice President Eshagh Jahangiri made the announcement last night, declaring that trading dollars above the new rate would be a serious crime.

In a decisive move intended to stop the further devaluation of the rial, the Rouhani government announced it would unify the official and free market dollar exchange rates, settling on an official rate of IRR 42,000.

First Vice President Eshagh Jahangiri made the announcement last night, declaring that trading dollars above the new rate would be a serious crime. "Just like the smuggling of drugs, no one has the right to buy or sell [above the new rate]... If any other exchange rate is formed in the market, the judiciary and security forces will deal with it," he warned.

"There should not be such incidents in an economy that always has a surplus of foreign currency. Some say interference by foreign hands is disrupting the economic climate and some say domestic machinations are spurring these things in order to destabilize the climate in the country," added Jahangiri.

Earlier in the day, the Economic Commission of Iran’s parliament had summoned Minister of Economic Affairs Masoud Karbasian and Central Bank Governor Valiollah Seif for an emergency meeting regarding the careening value of the rial, which had reached a record low of IRR 60,000 to the dollar.

Speaking to reporters after the meeting, Karbasian continued the government line that the devaluation was not a reflection of the true state of the economy. Rather, he obliquely suggested that the “security agencies” ought to be summoned to explain the real cause for the fluctuations. His comments were an apparent reference to rumors that certain actors opposed to the Rouhani government, likely in the security establishment, were hoarding dollars in order to exacerbate speculation and undermine confidence in the government’s economic management.

However, in the face of this significant political pressure, the Rouhani administration made a bold move, instituting a policy that has eluded the country’s economic planners since the 1979 revolution. Rate unification has long been considered a necessary step to introduce more stability in Iran’s monetary policy and foster a better business environment for the country’s enterprises.

Iran's last major currency crisis of a similar scale took place in 2012. Then president Mahmoud Ahmadinejad similarly blamed psychological factors for the rout, arguing in a speech, "Are these currency fluctuations because of economic problems? The answer is no. Is this because of government policies? Never … It's due to psychological pressure. It's a psychological battle." His government similarly tried to unify rates at IRR 12,260. But sanctions made it difficult to generate sufficient supply of hard currency in Iran, and the unified rate collapsed after just a few months.

During this most recent currency crisis, the rial had lost about one-third of its value against the dollar over the last Iranian new year, which ended on March 20. The devaluation accelerated beginning in December, and the rise in the free market price of the dollar tracked closely with that of gold. Both gold and the dollar have been typical “safe-haven” investments for Iranians wishing to hedge against inflation and general economic uncertainty. However, inflation had remained flat over the previous twelve months, and real estate prices were relatively stable, suggesting little change in the purchasing power of the rial. The net effect was a rampant devaluation more akin to a bubble, fueled by rising doubts among Iranians about the survival of nuclear deal.

Though clearly responding to the recent turmoil, the Rouhani government had already begun the groundwork necessary for such a unification. In March of last year, Catriona Purfield, a senior economist at the IMF, suggested that Iran could perhaps unify the rates earlier than expected, stating, “Half of imports have been put on the market rate and most of the goods are now at the flexible rate. Interbank FX market has been reestablished. Therefore all the elements are there, so an early move is possible.”

The new rate of IRR 42,000 is closer to the rate economists expect would be necessarily for unification. Economists Mohsen Bahmani-Oskooee and Sahar Bahrami looked at exchange rate data from 1979 to 2015. They concluded that had Iran’s rial been allowed to depreciate in accordance to changes in purchasing power parity, the exchange rate in 2015 would have been around IRR 47,000. The rial’s purchasing power has been relatively stable in the last few years and so this is likely a fair estimation of the current dollar rate in PPP terms.

Yet, despite the clear economic rationale behind the rate unification, it will remain to be seen whether the political gamble pays off for Rouhani. The official exchange rate presented a lucrative arbitrage opportunity for quasi-state actors, who could purchase dollars at the lower official rate then sell the hard currency on the black market. These entrenched interests will no-doubt see the unification as a direct challenge by Rouhani, and a further example of his administration's continued efforts to reign-in rent seeking in the economy.

But for the general public, such a confidence-inspiring move should serve as an indication that the Rouhani cabinet, despite the claims of infighting and mismanagement, remains capable of the kind of coordinated policymaking necessary to reform the economy.

Photo Credit: Vahid Salemi

Governor of Sweden’s Central Bank Visits Iran for Technical Dialogue

◢ The governor of the Riksbank, Sweden’s central bank, is visiting Iran on April 5th on the invitation of Iran’s central bank governor Valiollah Seif. With an agenda focused on technical exchanges, a spokesperson for the Riksbank confirmed to Bourse & Bazaar that Ingves will give a presentation entitled “Central Banking and Financial Crisis: Lessons Learned.”

The governor of the Riksbank, Sweden’s central bank, will visit Iran on April 5-6 at the invitation of Iran’s central bank governor Valiollah Seif.

Stefan Ingves, the governor of the Riksbank will be leading a day of technical exchanges including a working dinner hosted by Sweden’s ambassador in Tehran, Helena Sångeland. The visit, which comes as political uncertainty around the nuclear deal reaches a fever pitch, underscores the long-standing commercial and economic relationship between Sweden and Iran. In February of 2017, Swedish Prime Minister Stefan Löfven visited Iran with an itinerary that included a visit to the Scania truck factory in Qazvin.

For the Central Bank of Iran, the visit by one of Europe’s most seasoned central bankers is a valuable opportunity to draw on the Riksbank’s experience in central banking, financial stability, and monetary policy. Ingves has held the position of Riksbank governor since 2006 and navigated the country through the 2009 global financial crisis. He is also the chairman of the Basel Committee on Banking Supervision, which sets global standards for prudential regulation of banks. Iranian banks have been undertaking extensive reforms in order to better conform to so-called “Basel” standards.

A spokesperson for the Riksbank confirmed to Bourse & Bazaar that Ingves will give a presentation entitled “Central Banking and Financial Crisis: Lessons Learned.” The topic is of particular relevance as Iran seeks to manage systemic risk in its banking sector stemming from non-performing loans, a key driver of the 2009 crisis. Sweden was one of the fastest recovering countries in the aftermath of the last major global recession, earning praise as a “rockstar of the recovery” for its combination of intelligent fiscal and monetary measures.

No doubt, Iran’s central bankers will listen to Ignves’ presentation attentively.

Photo Credit: Riksbank

First OECD Complaint Filed Against a European Company for its Activities in Iran

◢ The filing of a complaint against Italian telecommunications firm Italtel under the OECD Guidelines for Multinational Enterprises for its business activities in Iran is a warning about the scrutiny and politicized climate surrounding investment in the Islamic Republic. But companies can navigate these claims succesfully if they remain committed to responsible business and proactive monitoring.

When companies consider the risks associated with doing business in Iran they largely focus on sanctions. Yet this approach misses the increasing normative and regulatory requirements that companies also manage the social and environmental impacts of their activities. While the importance of managing these risks holds for any country, it is particularly salient in the Iranian context due to the scrutiny and politicised climate surrounding investment in the Islamic Republic.

The filing of the first complaint against a European company under the OECD Guidelines for Multinational Enterprises (the OECD Guidelines) for its business activities in Iran is a warning for what might lie ahead. Without prejudging on the merits of the complaint, this case is important for any company looking at doing business in Iran because it highlights a type of regulatory policy businesses are mostly unaware of, and because of its implications on the broader political environment to continue an economic opening towards Iran.

The Complaint

On 13 September 2017, three civil society organisations filed a complaint with the Italian Government against Italtel Group S.p.A, a major Italian telecom company regarding its business activities in Iran.

The complainants argue that the technologies and services offered by Italtel to its Iranian partner, the Telecommunications Company of Iran (TCI), breach multiple provisions of the OECD Guidelines by contributing to internet censorship and other rights violations in Iran and help the Iranian authorities, including the Islamic Revolutionary Guard Corps, to suppress political dissent and civil liberties in the country and in cyberspace. The complainants are asking the Italian government whether the company’s actions are consistent with the Guidelines and more importantly are calling for an immediate moratorium on current negotiations and business engagements between Italtel and TCI until the alleged breaches to the Guidelines are addressed.

The OECD Guidelines

The OECD Guidelines are recommendations addressed by Governments to multinational enterprises operating in or from one of the 48 adhering countries—that includes the 35 OECD countries and 13 additional countries ranging from Argentina to Kazakhstan to Ukraine. The Guidelines provide non-binding principles for responsible business conduct in areas such as employment and industrial relations, human rights, environment, information disclosure, combating bribery, consumer interests, human rights, science and technology, competition and taxation. Their impact has been felt the most extensively in the areas of human rights and labour relations.

The Guidelines, in line with the other key reference instruments on responsible business practices such as the United Nations Guiding Principles on business and human rights and the International Labour Organization’s Core Labour Standards, make clear that responsible business is not charity or philanthropy but about identifying, managing and remediating adverse impacts on social and environmental issues.

As the Guidelines are not legally binding, one might conclude they can easily be ignored. But the most unique feature of the Guidelines is that they require governments to set up “National Contact Points” whose role is to promote the Guidelines and, more importantly, to receive and handle complaints against alleged non-observance of the Guidelines. These complaints are not judicial cases in the classical sense. NCPs offer conciliation and mediation to facilitate consensual solutions to the alleged violation of the Guidelines. Again, it might be tempting to ignore NCPs due to their apparent lack of judicial standing. However, these cases increasingly lead to concrete consequences for companies found in non-compliance of the Guidelines.

As the OECD's own reports show, findings and recommendations of NCPs are increasingly being used by investors in their assessment of companies’ performances, including in decisions of divestment. Governments are increasingly looking at NCP findings and recommendations when and whether extending their support to companies. The most advanced example is probably Canada, which can withdraw its state support for companies in case of an established violation of the Guidelines or a failure to participate in good faith in the NCP process. More broadly, OECD export credit agencies have coordinated their policies to recommend that agencies take into account NCP statements when deciding whether to provide financial support. Individual NCP cases have also resulted in significant consequences for companies such as loss of future contracts.

NCPs have handled over 400 complaints, addressing impacts from business operations in over 100 countries and territories since 2000. Since 2011 there has been a steady increase in recourse to the NCPs, demonstrating growing confidence in the system. This, combined with the breadth of issues covered by the Guidelines and the relative ease of access to the NCP probably explain why civil society organizations decided to use the OECD system. The Italian case may well be a clear signal that NCPs will likely be increasingly used as a tool of strategic (quasi) litigation in the context of business activities in Iran.

Maybe Italtel activities do not amount to a breach of the Guidelines. Maybe they do, but unwillingly or unwittingly. The issues raised by the complaint are complex. Phone and ICT companies are increasingly forced to assess the balance between respecting basic human rights such as freedom of expression and privacy with government requests based on public security. Vodafone came under fire when it was forced to send out pro-government messages and shut down its network by the Egyptian government during the 2011 uprising. BlackBerry, when it was still a thing, faced a ban in India for refusing to provide access to customers' emails. Google left China after its servers were attacked to access information about activists and Apple recently opposed the US Government over users’ privacy.

In any case, it is fully in the interest of the company to use the opportunity of the NCP case to clarify the situation. NCPs focus on problem solving. It represents in the end a relatively easy way to reach a consensual and non-adversarial solution to its alleged challenges.

Responsible Economic Relations

The importance of the OECD Guidelines can also be felt at a very different level highlighted in a recent feature on Bourse & Bazaar. The feature discussed the question of whether Iran is a “good country” as essential for business leaders and governments as they try to justify market entry plans to board members, shareholders, and their national constituencies while critics of the Iran nuclear deal claims more forcefully than ever that investing in Iran will further enable the “bad behavior” of the Iranian state

This good/bad approach might seem simplistic but it reflects a very real dimension of the broader political environment surrounding companies and governments developing business and economic ties with Iran. They must be mindful of the heightened impact of negative headlines alleging that European businesses are harming people and the environment in the country just like irresponsible foreign investors risk compromising internal support in Iran for opening economic ties.

In this context, responsible business offers an additional tool to demonstrate that investments in Iran are “good” when they respect people and the environment. Reinforcing this perception, based on actual performances, will be crucial to strengthening broad acceptance of economic and business relations with Iran. Said differently, it is in the interest of investors, companies as well as governments in Europe and Iran to respect, support and implement concretely and convincingly the OECD Guidelines and more broadly responsible business practices in Iran.

Photo Credit: Wikicommons

Iran Financing at Austria's Oberbank 'On Hold' Because of Trump

◢ A new report in Austria's Die Presse confirms that one of the first Western banks to sign a deal to provide project financing to Iran has had to put its projects “on hold” due to the uncertainties surrounding the Iran nuclear deal. Oberbank had signed an agreement to extend a EUR 1 billion line of credit to Iran in September of last year.

A new report in Austria's Die Presse confirms that Oberbank, one of the first Western banks to sign a deal to provide project finance to Iran, has put projects “on hold” due to the uncertainties surrounding the Iran nuclear deal.

Oberbank, Austria’s seventh-largest bank despite its regional focus and limited exposure to the U.S. financial system, had signed an agreement to extend a EUR 1 billion line of credit to Iran in September of last year. The deal was announced to much fanfare as political uncertainty increased around the expectation that President Donald Trump would “decertify” the nuclear deal later that October—a step the American leader did subsequently take.

The finance deal, which was signed with the express support of Iran’s central bank as well as the Austrian government, was intended to support capital-intensive infrastructure and energy projects led by Austrian companies and was earmarked for projects of over two years in duration. While Oberbank has long provided trade finance in areas that are exempt from sanctions, such as food and pharmaceuticals, the provision of project finance was considered a significant boost to Iran’s engagement with the European financial system. Denmark’s Danske Bank signed a similar agreement shortly after their Austrian peers.

However, in a presentation to shareholders by Oberbank CEO Franz Gasselsberger, the Iran project emerged as a rare blemish in an otherwise strong annual report. As Die Presse reports, Gasselsberger told those present that the financing of projects in Iran remains “on hold” because the current U.S. policy "complicates the business massively.” Moreover, the prospect that secondary sanctions could “snapback” on May 12 if Trump refuses to reissue key sanctions waivers was highlighted as something the bank’s leadership will need “take a close look at.”

Photo Credit: Wikicommons

The Iran Deal’s On Life Support: Time To Pull The Plug

◢ The JCPOA has become a liability for Iranian diplomacy. The "fix not nix" strategy has allowed the U.S. to sour the Europe-Iran relationship and focus nearly all diplomatic efforts on preserving the deal, rather than building new foundations for political and economic engagement. Iran ought to consider taking control by leaving the JCPOA as part of a strategy that keeps its key non-proliferation commitments intact.

This article was originally published in Lobelog.

The saga of the Iran nuclear deal has taken another bizarre turn. Eli Lake, a longtime skeptic of the deal, yesterday published a much-discussed Bloomberg View piece in which he surprisingly argues that “to withdraw from the Iran deal now would be a mistake.” Lake’s piece reflects a new line of thinking that has emerged from the campaign to “fix” the Joint Comprehensive Plan of Action (JCPOA).

With the recent appointment of John Bolton as national security advisor and the prognostications of Israeli Prime Minister Bibi Netanyahu, it is now being taken largely for granted that Trump will withdraw from the Iran deal. But summarily nixing the deal on May 12, the date when Trump would need to once again waive U.S. secondary sanctions in order to remain in the deal, might pose a problem. The “fix not nix” strategy, which has been advanced since Trump’s de-certification of the agreement in October 2017, reflects a concern in Washington that if Trump abrogates the deal in a flourish of executive privilege, he will harm transatlantic relations and make the U.S. seem responsible for any subsequent escalation or blowback.

For some months, the date of May 12 has loomed over the U.S.-E3 negotiations to find a fix to the deal by giving Europe the chance to compel Iran into a package of add-ons and concessions. Time is running out, and Trump seems determined to kill the deal by his own small hands. Ever aware of the optics, Mark Dubowitz, CEO of the Foundation of Defense of Democracies (FDD), has suggested a “safe harbor” period which would extend to November 12, during which the sanctions re-imposed in May would not be enforced, thereby granting a greater window for negotiations on a “real fix.”

At first glance, this might look like a reasonable accommodation. But in truth, it is an effort to bait Iran into a harsh reaction that kills the deal. The failure to renew sanctions waivers on May 12, even if sanctions snapback is delayed, will trigger substantial political pressure for the Rouhani administration or other elements within Iran’s state to respond. Should that response be escalatory—and if it takes place within the window of time before the United States has actually redesignated entities and reimposed sanctions—it will look like the Iranians were the party that abrogated the deal first during a period of “extended negotiations.”

Unworkable Fix

There are four clear signs that the strategy to pursue a “fix,” even with more time, is unworkable. The first sign is that Trump has never independently articulated what an acceptable fix would look like. His antipathy for the Iran deal is clearly more emotional than rational, stemming from his view of the deal as a key achievement of the Obama administration. Even if a rational fix were to be devised, it would still be vulnerable to Trump’s sentiment that the deal should not be saved. It may even be the case that the JCPOA is the primary reason why Trump cares about Iran at all. With the deal off the table, the unlikely tag team of Saudi Crown Prince Mohammad bin Salman and Bibi Netanyahu may have less success weaponizing the White House against Iran.

Second, the elevation of Mike Pompeo to secretary of state and John Bolton to national security advisor only compounds the problem of Trump’s impulses as he has surrounded himself with individuals who have a nearly pathological obsession with Iran as an adversary. These new advisors may find the pretense to escalate even if the JCPOA were “fixed.” Iran can no longer rely on the nuclear deal alone to underpin a basic detente with the Americans and therefore needs to begin investing in other methods of counterbalancing.

Third, there has been reduced capacity for reasonable action among the bureaucracy. The Treasury Department’s Office of Foreign Assets Control (OFAC) has failed to issue a single new license for commercial activities in Iran to date. OFAC has a clear institutional interest in creating a robust but navigable regulatory environment. The Trump administration’s Iran posture has overriden this interest, even prior to snapback, which suggests that waiver renewal would be insufficient to ensure that Iran receives the expected economic benefit from the nuclear deal.