Iranian Protests And The Working Class

◢ There is growing consensus that the core constituency of the recent wave of protests in Iran is working class youth who feel "forgotten" in the country's economic plan.

◢ The expected post-sanctions windfall has yet to materialize and the Rouhani administration will need to decide whether it will compromise on its austerity-type budgets in order to offer some near-term economic relief.

This article was originally published in Lobelog.

In February of 2017, I wrote about Iran’s “forgotten man,” the member of the working class who seemed invisible in the talk of the country’s post-sanctions recovery:

What has been lost is an appreciation that the “normalization” of relations between Iran and the international community is as much about elevating “normal Iranians” into a global consciousness, as it is about matters of international commercial, financial, and legal integration. While there has been progress in building awareness of Iran’s young and highly educated elite, whose start-ups and entrepreneurial verve play into the inherent coverage biases of the international media, a larger swath of society remains ignored. By a similar token, the rise of the “Iranian consumer” with untapped purchasing power and Western tastes has been much heralded, but the reporting fails to appreciate that Iran’s upper-middle class rests upon a much larger base whose primary economic function is not consumption, but rather production.

With the new wave of protests sweeping Iran, it seems that the country’s forgotten men and women may be mobilizing to ensure their voices are heard in Iran and around the world. There is a growing consensus that the protests are comprised primarily of members of the working class, who are most vulnerable to chronic unemployment and a rises in the cost of living.

The idea that these are working class protests has explanatory power. First, if the protests are indeed a working-class mobilization, then they are less surprising, and can be seen as akin to the regular “bread riots” that took place during Ahmadinejad’s second term, when Iran’s economy suffered its sharpest contractions.

Second, a working class outlook may explain why the political slogans and imagery of the Green Movement have not been deployed by the protestors. The Green Movement was a predominately middle class movement focused on civil rights, which emerged in response to a chosen candidate being fraudulently denied an election victory. Solidarity with lower class voters was limited and economic grievances were not a central focus.

Third, such a demographic composition may explain the support conservative political groups in Iran have given to the protestors, despite the spectacle and soundtrack of anti-state slogans that have marked many of the gatherings. Conservative politicians are being careful not to alienate members of their base, while trying to cast the protests the predictable outcome of Rouhani’s economic policies. Moreover, a working class composition of the protests can explain how exactly Iran witnessed a successful presidential election with historic turnout and a clear victor just six months before mass mobilizations in cities across the country to protest the government. It may be that those turning to protest now feel their voice was not heard in the May elections.

A simple comparative review of upper-middle income countries such as Iran—including Brazil, Mexico, Thailand, and Russia, among others—demonstrates that while protests end with political expressions, they usually begin with economic motivations. That Iran’s working classes are ready to mobilize, and that the mobilization was so quick, makes sense within the context of Iran’s current economic malaise.

It is generally overlooked when discussing Iran’s post-sanctions economy that Rouhani has operated an austerity budget since his election in 2013. Some even describe his policies as “neoliberal.” While an imperfect descriptor, his administration’s economic approach does broadly correspond to the neoliberal “Washington consensus,” which seeks economic reform through trade liberalization, privatization, tax reform, and limited public spending, focus on foreign direct investment, among other policies.

Such an economic approach is in many ways understandable. Rouhani is seeking to correct the populist excesses of the Ahmadinejad administration while also addressing longstanding structural issues in Iran’s economy such as its overextended welfare system, a reliance on state-owned enterprise, and cronyism and corruption. But these are, by dint of difficulty, long-term reform projects, which may not fully cohere until after Rouhani’s tenure has ended. In a way, it is laudable that the administration is applying such an outlook for the benefit of what Homa Katouzian has called a “short-term society.” But the near-term political costs are becoming clear.

Rouhani’s budget is ultimately ill-suited to addressing the economic imperative of job creation, which is urgent and at the heart of popular dissatisfaction. As economist Djavad Salehi-Esfahani has written in response to Rouhani’s most recent budget:

One of the main stated goals of this budget is to create jobs, but it is hard to see how it can do that by slashing the development budget at a time that interest rates are very high (they exceed inflation by 5 percentage points or more). The unemployment rate has been rising in the five years that Rouhani has been in office, mainly because of increased supply pressure, but low demand has been an equal culprit. With unfavorable news about the future of the nuclear deal and the removal of sanctions, thanks to the 180-degree turn in US policy toward Iran, the prospects for a foreign-investment driven recovery are dim. With public patience running low, the debates in the parliament over this budget should be more serious than the usual haggling over the needs of special interests.

Most governments in Rouhani’s position pursue expansionary monetary policy and boost public spending to try to drive investment and economic growth. But Iran faces a series of economic challenges that complicate such a response. For example, the principle economic achievement of the Rouhani administration has been to bring inflation under control. The International Monetary Fund expects inflation to sit below 10% this year, down from 40% in 2013. Controlling inflation is critical to bringing stability to prices in Iran’s basket of goods, where other market forces continue to drive up prices. Any attempt to pump money into Iran’s economy to spur investment risks undermining the success on inflation.

Additionally, in the face of low-growth, central banks commonly lower interest rates to make it cheaper to finance new investment. But Iran’s interest rates are being slowly rolled back from a high of 22% to the present level of 18%. Slow adjustments are necessary due to Iran’s banks being overleveraged. Reducing the interest rate too drastically, especially as inflation remains stubborn, would have two effects. First, savers would see their deposits lose value. This would predominately hurt lower-income savers who have a less diversified range of assets. Members of the middle class still benefit from asset appreciation in still robust categories like real estate, stocks, or even gold. Middle class fortunes have improved somewhat following the nuclear deal for this reason. On the contrary, members of the working class rely on interest-bearing deposits accounts to conserve wealth and are therefore very vulnerable to fluctuations in interest rates. The controversy over the unsustainable interest rates offered by unlicensed savings and loan institutions, which spurred protests in cities across Iran in the summer 2017, is indicative of the vulnerability.

Second, a lower interest rate would threaten the financial wellbeing of many of Iran’s banks, which have long skirted reserve ratios and amassed toxic debt. Any attendant drop in deposits would make it even harder for banks to shore up their reserves, making politically fraught recapitalization by the central bank more likely. In the recent assessment of Parviz Aghili, CEO of Iran’s Middle East Bank, it would cost as much as $200 billion to bring Iran’s $700 billion balance sheet in compliance with Basel III standards, which call for a minimum leverage ratio of 6%. By comparison, Rouhani’s total budget for the next Iranian calendar year is $104 billion.

In the face of limited options, the Rouhani administration believed that post-sanctions trade and investment, made possible by the sanctions relief afforded under the Iran nuclear deal, would enable the country to kick-start growth and investment that supports job creation. But the economic dividend of the nuclear deal has not materialized as anticipated. The majority of business leaders believe that this is primarily due to external factors, namely President Trump’s threats to re-impose sanctions on Iran, rather than Iran’s own challenging business environment. The nuclear deal has been so central to Rouhani’s economic plan, with the nuclear deal and investment deals basically conflated in much of the discourse, that the concern around the future of the nuclear deal has also hit confidence in Rouhani’s economic management at large.

Overall, Rouhani is running an austerity budget because he is between a rock and a hard place. The policies he is adopting are economically sensible and necessary—so much so that the budgets have been passed despite pushback from parliament and other corners of the Iranian power structure as to the approach, neoliberal or not. But the policies are politically costly, testing the patience of a people who feel that the hopes for a better livelihood slipping away as the years pass. As Mohammad Ali Shabani writes, the circumstances in Iran can be described by the concept of the J-curve, which posits that mobilizations occur “when a long period of rising expectations and gratifications is followed by a period during which gratifications … suddenly drop off while expectations … continue to rise.”

We cannot fault Iranians for their rising expectations, for they are a people who know their immense potential. This is especially true of the working classes, who have built Iran’s diversified economy with their labor and the country’s rich culture with their values. As Iran has grown richer and more advanced, the burgeoning middle class has come to represent the future. But the recent experiences of wealthier economies offer a cautionary tale about “forgetting” the working classes, and sacrificing their expectations to protect the gratification of others.

Photo Credit: IKCO

To Break With Austerity, Rouhani Must Deliver on Sovereign Debt Sale

◢ To win foreign investment, Iran's needs to boost development expenditures. But expansionary fiscal policy will require a new source of revenue, as oil sales remain stagnant and tax rises remain politically risky.

◢ A sovereign debt sale, long discussed by Iranian officials, is the fundamental way Iran can find the revenues to self-fund growth. The Rouhani administration must focus on making its bond offering a reality.

One of the remarkable, and yet little discussed, aspects of the Iranian election is that Hassan Rouhani triumphed despite being an austerity candidate. His first term was notable for its frugal budgets and commitment to both slash government handouts and reduce expenditures in an effort to tackle inflation. On one hand, the focus on a more disciplined fiscal and monetary policy meant that Rouhani could point to a successful reduction of inflation from over 40% to around 10% while on the campaign trail. On the other hand, job creation has been stagnant and the average Iranian has seen little improvement in their economic well-being.

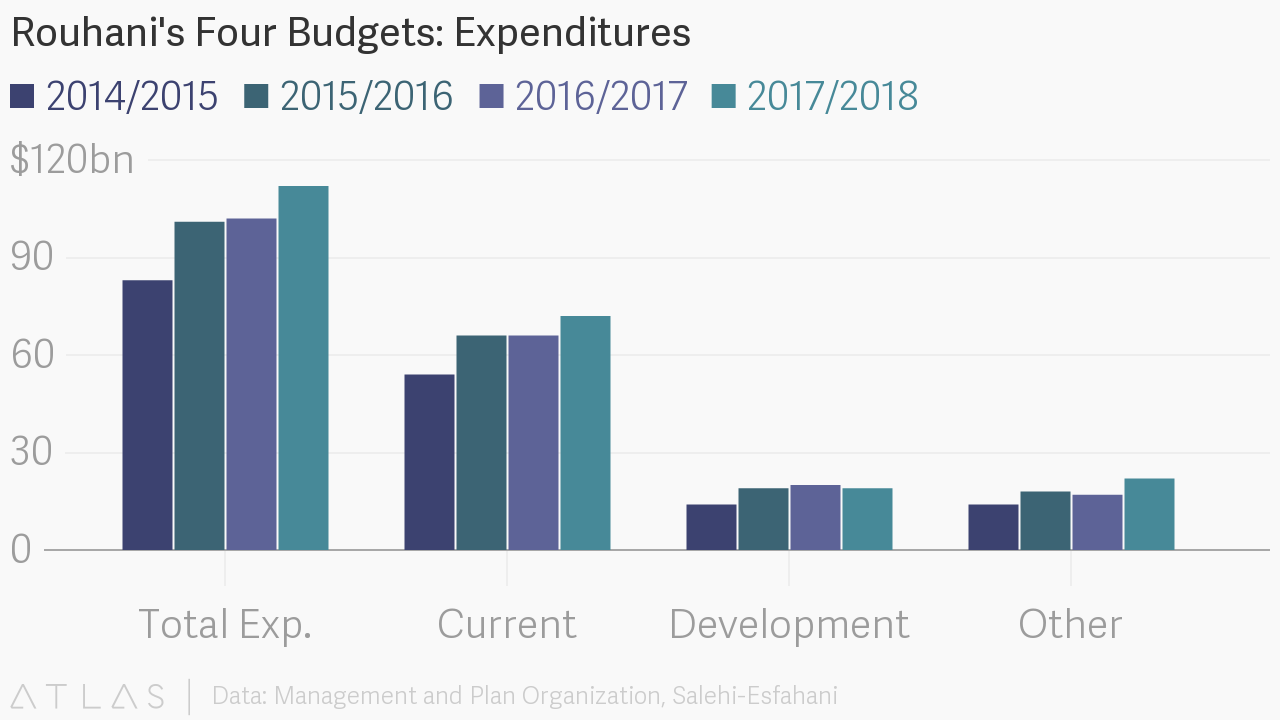

Some economists, including Djavad Salehi-Esfahani, have argued that Rouhani’s austerity economics are misguided, depriving the economy of vital liquidity that could help jumpstart investment and job creation. For example, Iran’s 2017/2018 budget sees tax revenues stay constant at an equivalent of USD 34 billion despite the fact that economic growth is expected to top 6%. Salehi-Esfahani believes that these figures reflect the Rouhani administration's belief “that letting the private sector off easy would encourage it to invest.” The government, meanwhile, will not contribute much more in investment. Development spending is set to decrease from USD 20 billion to USD 19 billion.

Surely, the Rouhani administration’s pursuit of a small government that leaves the burden of job creation and economic growth to the private sector is admirable. It represents a significant shift in the mentality that has characterized the economic policy of the Islamic Republic, which has long relied on state-owned enterprise and state-backed financing, supported by oil revenues, to drive economic growth.

But the volume of investment needed to revitalize economic sectors and create substantial job opportunity has not yet materialized. This is an undeniable fact, which Rouhani has attributed to failures on the part of Western powers to adequately implement sanctions relief, leaving international banks unable to work with Iran. Rouhani’s opponents meanwhile, attributed low volume of foreign direct investment to his administration's mismanagement. There is truth to both accounts.

In many ways, Rouhani’s lean towards austerity was a response to the spendthrift policies of his predecessor, Mahmoud Ahmadinejad. The Ahmadinejad administration responded to faltering economic growth during a period of historic oil revenues by ploughing oil rents into the banking system and compelling banks to issue loans. These loans were often provided without the adequate due diligence and were used not to finance growth, but increasingly to fuel speculation, or more forgivably, to address cash flow difficulties faced by companies as a result of international sanctions.

As a result, Iran’s banking sector is now weighed down with a high proportion of non-performing loans, accounting for around 11% of total bank debt. When bank balance sheets grew increasingly precarious as non-payment of loans mounted in the sanctions period, competition for deposits grew. Exacerbating this competition, banks needed to provide higher deposits rates in order to stay ahead of inflation. The combination of forces pushed interest rates up to all-time highs.

The debt market in Iran is now broken. The IMF has urged urgent action to “restructure and recapitalize banks.” In the meantime, banks remain disinclined to lend and in the instances where healthier banks are able to provide loans, borrowers must contend with the high cost of debt.

This may help explain why the Rouhani administration so aggressively sought to address inflation—it was a necessary step to reduce the benchmark interest rate, which has so far been reduced from a high of 22% in 2014 to the current rate of 18%.

But even at such time that interest rates normalize, barriers will remain to the use of debt markets. At a structural level, Iranian companies, particularly in the private sector, rely on equity financing rather than debt financing in order to fund growth. This reflects a “bloc” behavior within Iranian enterprise. Partially as a consequence of the continued dominance of family-owned businesses in Iran’s non-state economy, business leaders tend to approach financiers within their own networks or holding groups, and many of Iran’s largest companies and banks anchor conglomerates that grew out of sequential processes of a kind of inward-looking venture capital. There is limited comfort among Iranian business leaders to seek funding from groups outside of these tight networks and by the same token, equity investors hesitate to provide finance projects outside their own networks. This means that the pool of available investor capital is rarely competing across the whole pool of available capital deployments—a significant inefficiency.

Growth-oriented investing itself can be a difficult strategic proposition. Iranian business leaders have understandably prioritized weathering periods of uncertainty over the execution of long-term plans. The challenge of dealing with short-term volatility has naturally favored short-term thinking. Major companies are only recently undertaking strategic reviews that might identify needs to invest in capital improvements or new services in order to drive growth in support of long-term goals.

The combination of the bloc effect in equity financing and the broken debt market creates a major brake on economic growth, especially from a supply-side perspective. To restore momentum, a third party is needed to order to reset the incentives and mechanisms around financing in Iran.

From the outset of its tenure, the Rouhani administration has hoped foreign investors would take on this role. An influx of foreign investment would have triggered growth without requiring the Rouhani administration to pursue difficult political gambles, such as expanding government expenditure for growth investments in the same period in which welfare programs are being culled. Moreover, the administration’s budgetary leeway was significantly reduced given the persistently low price of oil, making any such balancing act even more fraught.

Eighteen months after Implementation Day, it is clear that the administration significantly overestimated both the attractiveness of the market and underestimated the hesitation of major banks to resume ties with Iran. Investing in Iran is neither easily justified nor easily executed.

The country lacks two essential qualities that have characterized most emerging and frontier markets in the last decade. First, most emerging economies are not as diversified as Iran’s, and do not have such a large arrange of incumbent players with whom any foreign multinational or investor will need to compete for marketshare. There tend to be more “greenfield” opportunities in which lower capital commitment can generate higher returns. Second, a nearly universal feature among emerging markets is the consistent application of both expansionary monetary and fiscal policy. Such policy makes it possible for each investor dollar to achieve a higher return.

In its commitment to reduce interest rates and return the debt markets to normalcy, the Rouhani administration is pursuing an appropriate monetary policy—eventually lenders will become active again. But what remains perplexing is the insistence on austere government budgets in the face of low commitment from foreign investors.

It is clear that the Rouhani administration cannot easily spend tax and oil revenues on long-term projects. Oil revenues are stagnant and there is limited political will to raise taxes. At current levels of government revenue, the political risks of such expenditure are high; as the presidential election showed, populism remains a potent rallying cry among Iranian voters. But foreign investors can’t be expected to step into the gap. Direct equity investments remain a hard sell when domestic financing, whether in equity or debt form, remains throttled and liquidity challenges abound.

There is however a feasible solution that has seen much discussion, but little action—Iran’s return to international debt markets. A sovereign bond issue would both provide Iran’s government the opportunity to raise expenditures in a way that does not draw from existing sources of state revenue by providing a wide class of investors exposure to Iran’s expected period of economic growth. Such a security, ultimately backed by the country’s oil revenues, would serve to mitigate perceptions of country risk for creditors.

In May of 2016, Iran’s finance minister Ali Tayebnia disclosed that discussions were taking place with Moody’s and Fitch over restoring Iran’s sovereign credit rating. One year later, the debt sale continues to be a point of discussion. Recently, Valliolah Seif, Governor of the Central Bank of Iran, commented that the country will issue debt “when [Iran] becomes certain that there is demand for [its] debt.”

Seif’s comments allude to the essential problem of Iran’s planned debt sale—marketing. In order to get Iranian bonds onto the market in any substantial way, the country would need the support of major international banks to serve as underwriters. But banks remain hesitant due to sanctions and political risks.

Turkey, a country which presents creditors significant political risk without mitigation of oil revenues, was able to raise USD $2 billion in a Eurobond sale in January of this year. The sale was underwritten by Barclays, Citigroup, Goldman Sachs and Qatar National Bank.

Iran, is fundamentally a more attractive investment opportunity than Turkey. But major banks remain hesitant to provide financial services to Iran. The Rouhani administration needs to make the sovereign debt sale a core focus of its dialogue with European and global counterparts, and insist on political and technical support in order to entice 2-3 major banks to come on board. In the same manner that the Joint-Commission oversees implementation of the Iran nuclear deal, a multidisciplinary working group needs to be formed to manage the implementation of the debt sale. With the right stakeholders engaged, one can a combination of early-mover banks from Europe, Russia, and Japan agreeing to underwrite the bond issue.

Encouragingly, the delays may have played to Iran’s favor. Emerging markets are just now beginning to rebound, and investors have driven sovereign debt sales to record highs. The Rouhani administration must seize this opportunity and move beyond the limitations of its present austerity economics.

Photo Credit: Wikicommons